Question: 26. Arthur Plc. is considering undertaking a project which is expected to have a useful life of 4 years. Its current purchase price is 2,500.

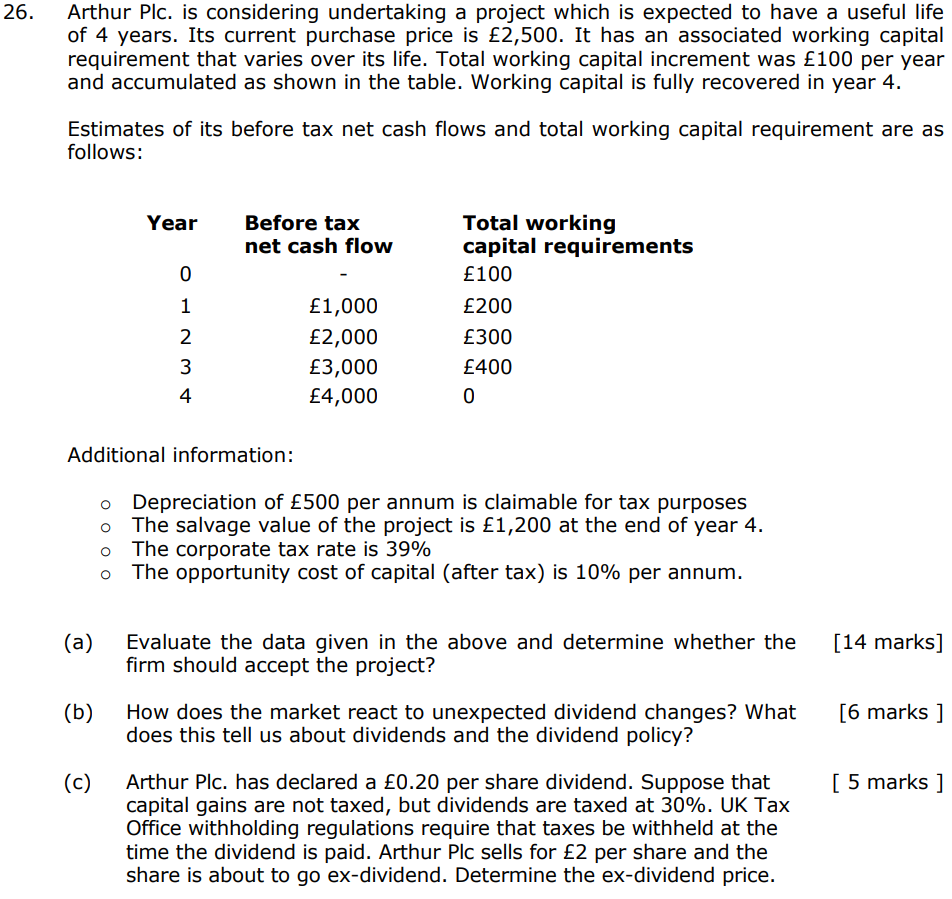

26. Arthur Plc. is considering undertaking a project which is expected to have a useful life of 4 years. Its current purchase price is 2,500. It has an associated working capital requirement that varies over its life. Total working capital increment was 100 per year and accumulated as shown in the table. Working capital is fully recovered in year 4. Estimates of its before tax net cash flows and total working capital requirement are as follows: Year Before tax net cash flow 0 1 2 3 4 1,000 2,000 3,000 4,000 Total working capital requirements 100 200 300 400 0 Additional information: Depreciation of 500 per annum is claimable for tax purposes The salvage value of the project is 1,200 at the end of year 4. o The corporate tax rate is 39% The opportunity cost of capital (after tax) is 10% per annum. (a) Evaluate the data given in the above and determine whether the firm should accept the project? [14 marks] (b) [6 marks ] How does the market react to unexpected dividend changes? What does this tell us about dividends and the dividend policy? (c) [ 5 marks ] Arthur Plc. has declared a 0.20 per share dividend. Suppose that capital gains are not taxed, but dividends are taxed at 30%. UK Tax Office withholding regulations require that taxes be withheld at the time the dividend is paid. Arthur Plc sells for 2 per share and the share is about to go ex-dividend. Determine the ex-dividend price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts