Question: 26.. I need the solution, the full, correct solution!I will give a thumbs up! A savvy business owner who owns several chicken franchises is seeking

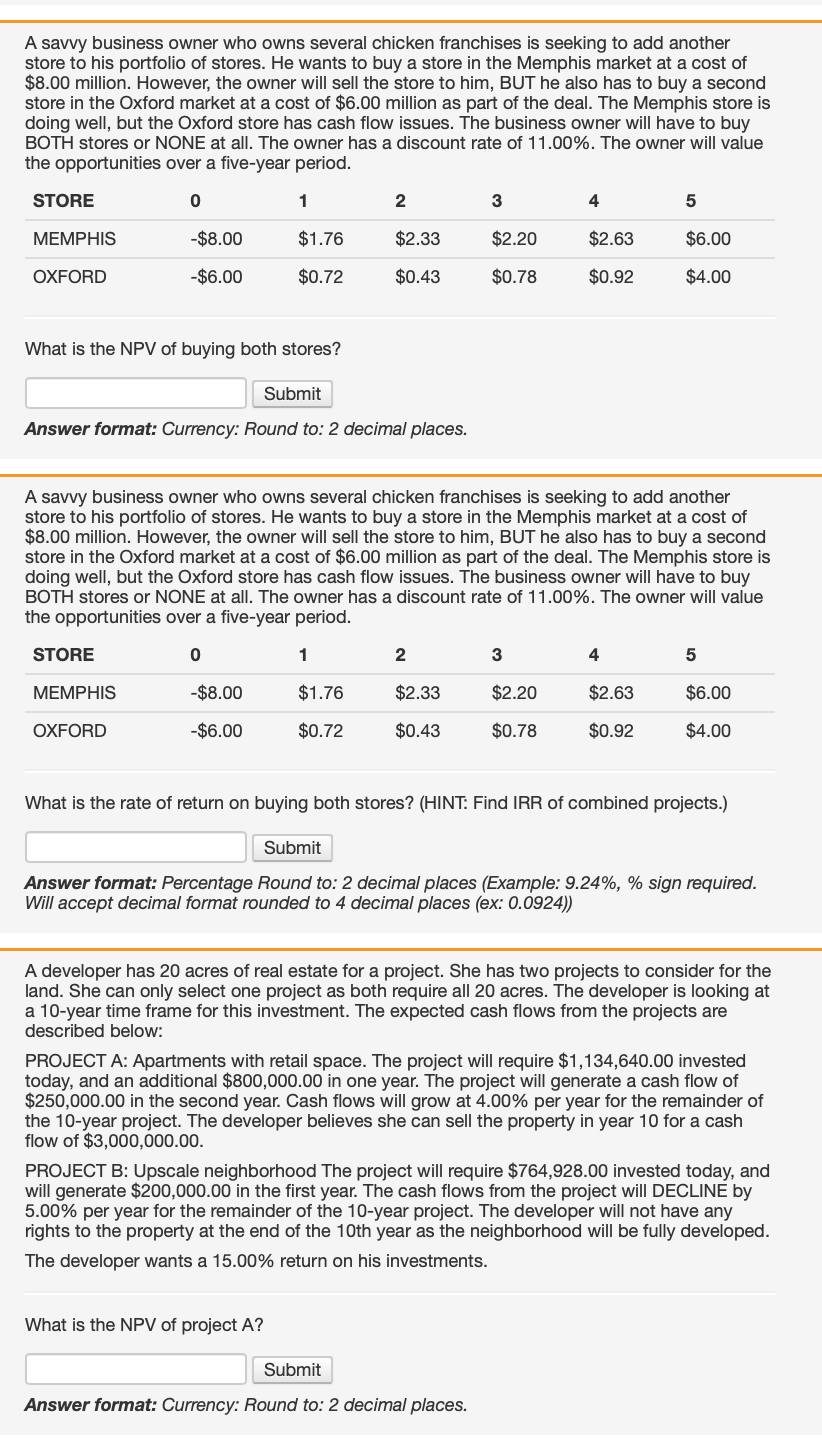

26.. I need the solution, the full, correct solution!I will give a thumbs up!  A savvy business owner who owns several chicken franchises is seeking to add another store to his portfolio of stores. He wants to buy a store in the Memphis market at a cost of $8.00 million. However, the owner will sell the store to him, BUT he also has to buy a second store in the Oxford market at a cost of $6.00 million as part of the deal. The Memphis store is doing well, but the Oxford store has cash flow issues. The business owner will have to buy BOTH stores or NONE at all. The owner has a discount rate of 11.00%. The owner will value the opportunities over a five-year period. What is the NPV of buying both stores? Answer format: Currency: Round to: 2 decimal places. A savvy business owner who owns several chicken franchises is seeking to add another store to his portfolio of stores. He wants to buy a store in the Memphis market at a cost of $8.00 million. However, the owner will sell the store to him, BUT he also has to buy a second store in the Oxford market at a cost of $6.00 million as part of the deal. The Memphis store is doing well, but the Oxford store has cash flow issues. The business owner will have to buy BOTH stores or NONE at all. The owner has a discount rate of 11.00%. The owner will value the opportunities over a five-year period. What is the rate of return on buying both stores? (HINT: Find IRR of combined projects.) Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) A developer has 20 acres of real estate for a project. She has two projects to consider for the land. She can only select one project as both require all 20 acres. The developer is looking at a 10-year time frame for this investment. The expected cash flows from the projects are described below: PROJECT A: Apartments with retail space. The project will require $1,134,640.00 invested today, and an additional $800,000.00 in one year. The project will generate a cash flow of $250,000.00 in the second year. Cash flows will grow at 4.00% per year for the remainder of the 10 -year project. The developer believes she can sell the property in year 10 for a cash flow of $3,000,000.00. PROJECT B: Upscale neighborhood The project will require $764,928.00 invested today, and will generate $200,000.00 in the first year. The cash flows from the project will DECLINE by 5.00% per year for the remainder of the 10 -year project. The developer will not have any rights to the property at the end of the 10th year as the neighborhood will be fully developed. The developer wants a 15.00% return on his investments

A savvy business owner who owns several chicken franchises is seeking to add another store to his portfolio of stores. He wants to buy a store in the Memphis market at a cost of $8.00 million. However, the owner will sell the store to him, BUT he also has to buy a second store in the Oxford market at a cost of $6.00 million as part of the deal. The Memphis store is doing well, but the Oxford store has cash flow issues. The business owner will have to buy BOTH stores or NONE at all. The owner has a discount rate of 11.00%. The owner will value the opportunities over a five-year period. What is the NPV of buying both stores? Answer format: Currency: Round to: 2 decimal places. A savvy business owner who owns several chicken franchises is seeking to add another store to his portfolio of stores. He wants to buy a store in the Memphis market at a cost of $8.00 million. However, the owner will sell the store to him, BUT he also has to buy a second store in the Oxford market at a cost of $6.00 million as part of the deal. The Memphis store is doing well, but the Oxford store has cash flow issues. The business owner will have to buy BOTH stores or NONE at all. The owner has a discount rate of 11.00%. The owner will value the opportunities over a five-year period. What is the rate of return on buying both stores? (HINT: Find IRR of combined projects.) Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) A developer has 20 acres of real estate for a project. She has two projects to consider for the land. She can only select one project as both require all 20 acres. The developer is looking at a 10-year time frame for this investment. The expected cash flows from the projects are described below: PROJECT A: Apartments with retail space. The project will require $1,134,640.00 invested today, and an additional $800,000.00 in one year. The project will generate a cash flow of $250,000.00 in the second year. Cash flows will grow at 4.00% per year for the remainder of the 10 -year project. The developer believes she can sell the property in year 10 for a cash flow of $3,000,000.00. PROJECT B: Upscale neighborhood The project will require $764,928.00 invested today, and will generate $200,000.00 in the first year. The cash flows from the project will DECLINE by 5.00% per year for the remainder of the 10 -year project. The developer will not have any rights to the property at the end of the 10th year as the neighborhood will be fully developed. The developer wants a 15.00% return on his investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts