Question: 26. In a substantive test, the maximum monetary error that the auditor is willing to accept in an account balance or class of transactions is

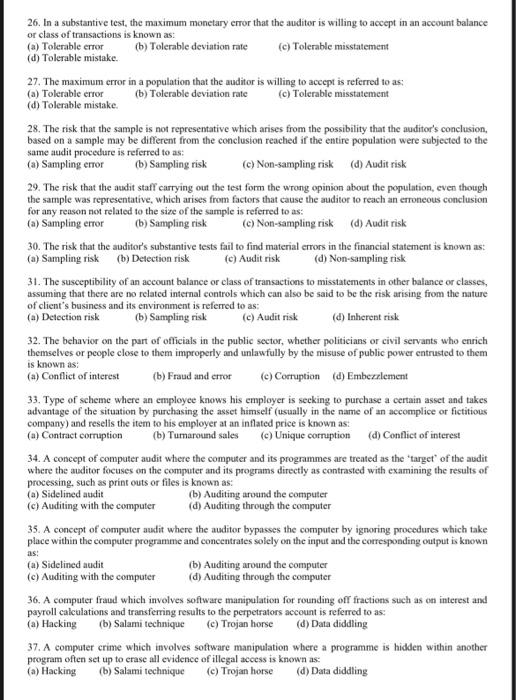

26. In a substantive test, the maximum monetary error that the auditor is willing to accept in an account balance or class of transactions is known as: (a) Tolerable error (b) Tolerable deviation rate (d) Tolerable mistake. (c) Tolerable misstatement 27. The maximum error in a population that the auditor is willing to accept is referred to as: (a) Tolerable error (b) Tolerable deviation rate (c) Tolerable misstatement (d) Tolerable mistake. 28. The risk that the sample is not representative which arises from the possibility that the auditor's conclusion, based on a sample may be different from the conclusion reached if the entire population were subjected to the same audit procedure is referred to as: (a) Sampling error (b) Sampling risk (c) Non-sampling risk (d) Audit risk 29. The risk that the audit staff carrying out the test form the wrong opinion about the population, even though the sample was representative, which arises from factors that cause the auditor to reach an erroneous conclusion for any reason not related to the size of the sample is referred to as: (a) Sampling error (b) Sampling risk (c) Non-sampling risk (d) Audit risk 30. The risk that the auditor's substantive tests fail to find material errors in the financial statement is known as: (a) Sampling risk (b) Detection risk (c) Audit risk (d) Non-sampling risk: 31. The susceptibility of an account balance or class of transactions to misstatements in other balance or classes, assuming that there are no related internal controls which can also be said to be the risk arising from the nature of client's business and its environment is referred to as: (a) Detection risk (b) Sampling risk (c) Audit risk (d) Inherent risk 32. The behavior on the part of officials in the public sector, whether politicians or civil servants who enrich themselves or people close to them improperly and unlawfully by the misuse of public power entrusted to them is known as: (a) Conflict of interest (b) Fraud and crrot (c) Corruption (d) Emberslement 33. Type of scheme where an employee knows his employer is seeking to purchase a certain asset and takes advantage of the situation by purchasing the asset himself (usually in the name of an accomplice or fictitious company) and reselis the item to his employer at an inflated price is known as: (a) Contract corruption (b) Tumaround sales (c) Unique cornuption (d) Conflict of interest 34. A concept of computer audit where the computer and its programmes are treated as the 'target' of the audit where the auditor focuses on the computer and its programs directly as contrasted with examining the results of processing, such as print outs or files is known as: (a) Sidelined audit (b) Auditing around the computer (c) Auditing with the computer (d) Auditing through the computer 35. A concept of computer audit where the auditor bypasses the computer by ignoring procedures which take place within the computer programme and coneentrates solely on the input and the corresponding output is known as: (a) Sidelined audit (b) Auditing around the computer (c) Auditing with the computer (d) Auditing through the computer 36. A computer fraud which involves software manipulation for rounding off fractions such as on interest and payroll calculations and transferring results to the perpetrators account is referred to as: (a) Hacking (b) Salami technique (c) Trojan horse (d) Data diddling 37. A computer crime which involves software manipulation where a programme is hidden within another program often set up to erase all evidenec of illegal aceess is known as: (a) Hacking (b) Salami technique (c) Trojan hotse (d) Dasta diddling

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts