Question: 26. Is buying a call exactly the same as writing a put? Explain whether or not all options that are in- the-money have intrinsic value.

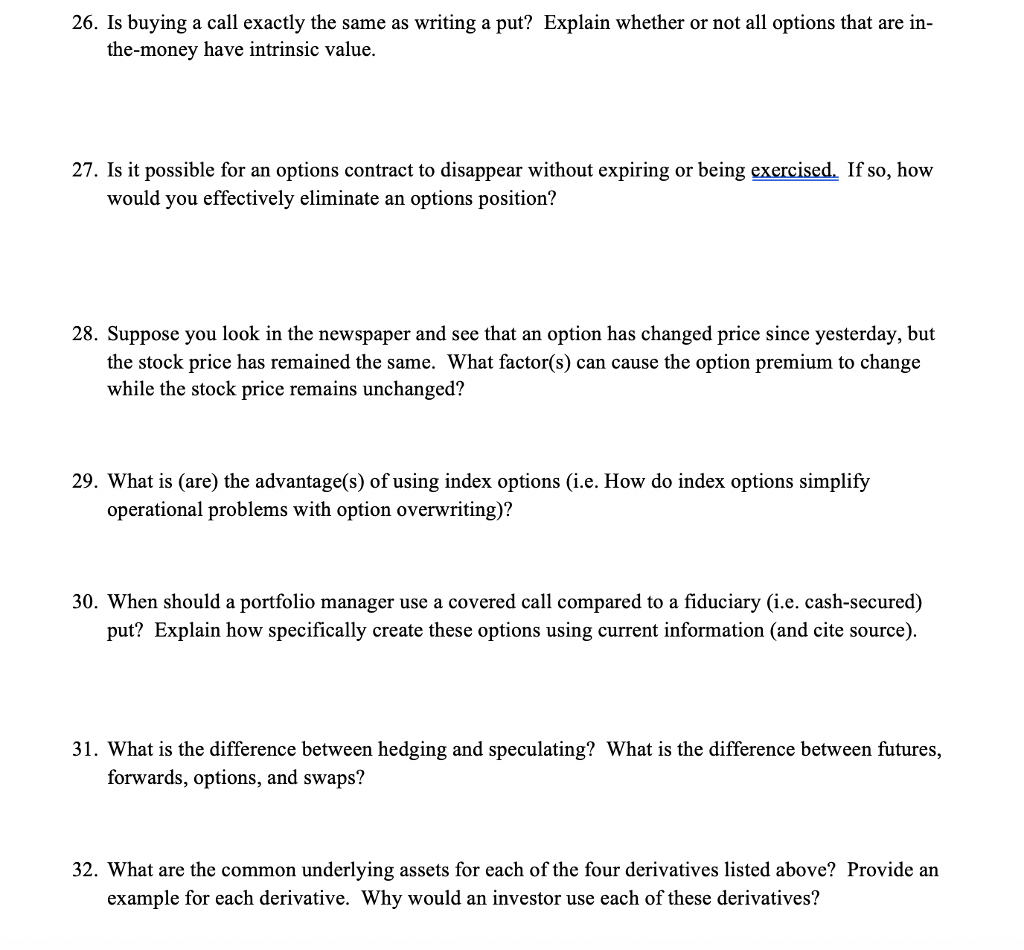

26. Is buying a call exactly the same as writing a put? Explain whether or not all options that are in- the-money have intrinsic value. 27. Is it possible for an options contract to disappear without expiring or being exercised. Ifso, how would you effectively eliminate an options position? 28. Suppose you look in the newspaper and see that an option has changed price since yesterday, but the stock price has remained the same. What factor(s) can cause the option premium to change while the stock price remains unchanged? 29. What is (are) the advantage(s) of using index options (ie. How do index options simplify operational problems with option overwriting)? 30. When should a portfolio manager use a covered call compared to a fiduciary (i.e. cash-secured) put? Explain how specifically create these options using current information (and cite source). 31. What is the difference between hedging and speculating? What is the difference between futures, forwards, options, and swaps? 32. What are the common underlying assets for each of the four derivatives listed above? Provide an example for each derivative. Why would an investor use each of these derivatives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts