Question: 26 MODULE 2 MODULE 2-1 Consumer Credit Analysis .. 2 3. 4. The following items of Information have been taken from an application for credit

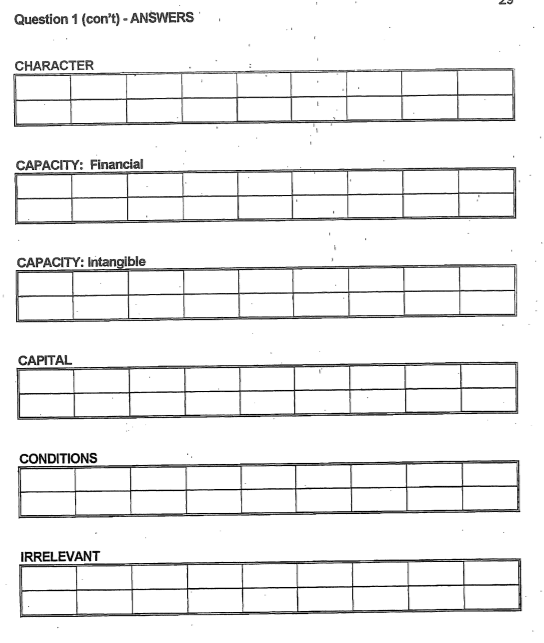

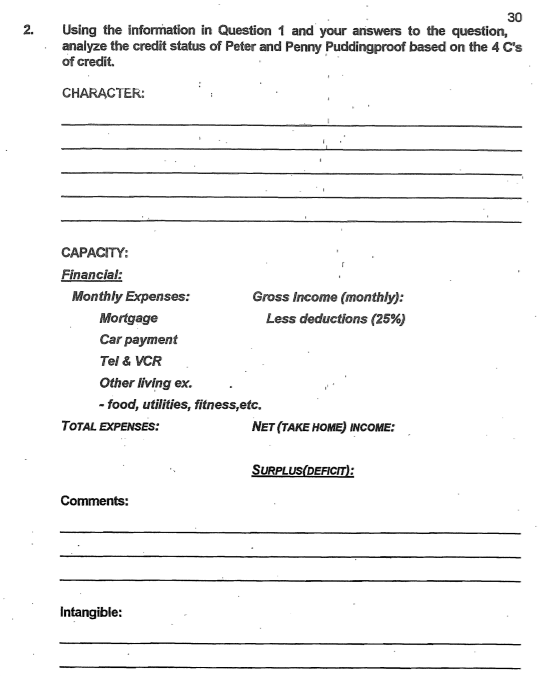

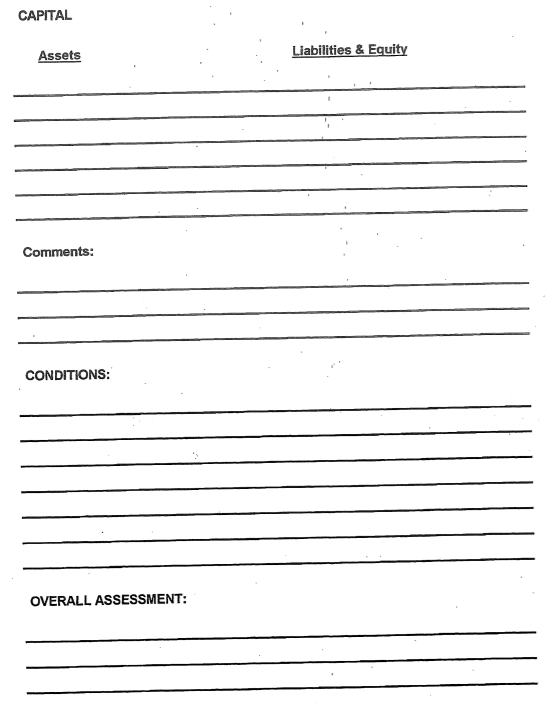

26 MODULE 2 MODULE 2-1 Consumer Credit Analysis .. 2 3. 4. The following items of Information have been taken from an application for credit (and other sources) from Peter Puddingproof. You are required to categorize each item under the C of credit to which it relates. (Some items my relate to more than one C. Also, some may be irrelevant). Answer by entering the number of the item in the appropriate box chart at the end of the question 1. Peter is 27 years old. He is married. His wife's name is Penny and they have two children, aged three years and one year. Peter is presently employed. He graduated from Seneca College in Ontario four years ago (business management program - finance and marketing). 5. Since graduation he has been employed by a fimm which imports Scandinavian furniture. It also manufactures some of its own products. It markets these all across Canada and in some parts of the U.S.A. Peter started his employment in the production department, spent two years in the general office (accounting and sales), and is now assistant marketing manager. 7. His present annual salary is $35,000. 8. Penny is not permanently employed. However, she intends to return to work in another year or so. Penny worked formerly for a trust company. She has been taking night school courses to qualify her as a loans officer. 6. 9. 15. 10. Peter has been taking additional courses in accounting and finance. 11. Two years ago they bought a home in the suburbs of Toronto. 12. The down payment on the home came partly from Registered Home Ownership Savings plans. The rest was advanced by Peter's father. 13. The purchase price of the home was $98,000. 14. The mortgage balance is presently $68,000. . Monthly mortgage payments, including taxes are $925. 16. Peter and Penny have two automobiles. Both are driven. 17. Peter's automobile is a recent model Chev Cavalier. Purchase price new was $13,500. 18. Monthly payments on the finance contract for Peter's car are $345. Balance owing on the contract is $7,500. 19. Penny's automobile is a six year old Chevette. Nothing is owing against it. 20. Penny's father used to play hockey for the Detroit Red Wings. 21. The company Peter works for has copyrighted some of their designs. They hope to sell these design rights in other countries under a licensing agreement. 22. Peter and Penny both belong to fitness/recreation clubs. 23. Peter hopes to buy recreational property in Muskoka. 24. Peter and Penny have three department store and two bank credit cards. The credit bureau reports payments on these generally good although there is occasional evidence of accounts running 30 days overdue. 25. They have just bought a new television and VCR which cost $1,200. They are paying this off at $100 a month. 10 Question 1 (con't) - ANSWERS CHARACTER CAPACITY: Financial CAPACITY: Intangible CAPITAL CONDITIONS IRRELEVANT 10 Question 1 (con't) - ANSWERS CHARACTER CAPACITY: Financial CAPACITY: Intangible CAPITAL CONDITIONS IRRELEVANT 28 26. Peter's company pays for its imports in U.S. dollars. 27. The company has just acquired the Canadian distribution rights for a line of high quality French-made poolside and patio furniture. 28. Peter and Penny are both gourmet cooks. They also dine out frequently at expensive restaurants, 29. Peter has a term insurance policy. His company pays his medial insurance and group insurance which includes disability. SUPPLY YOUR ANSWERS IN BOX CHART ON FOLLOWING PAGE. 26 MODULE 2 MODULE 2-1 Consumer Credit Analysis .. 2 3. 4. The following items of Information have been taken from an application for credit (and other sources) from Peter Puddingproof. You are required to categorize each item under the C of credit to which it relates. (Some items my relate to more than one C. Also, some may be irrelevant). Answer by entering the number of the item in the appropriate box chart at the end of the question 1. Peter is 27 years old. He is married. His wife's name is Penny and they have two children, aged three years and one year. Peter is presently employed. He graduated from Seneca College in Ontario four years ago (business management program - finance and marketing). 5. Since graduation he has been employed by a fimm which imports Scandinavian furniture. It also manufactures some of its own products. It markets these all across Canada and in some parts of the U.S.A. Peter started his employment in the production department, spent two years in the general office (accounting and sales), and is now assistant marketing manager. 7. His present annual salary is $35,000. 8. Penny is not permanently employed. However, she intends to return to work in another year or so. Penny worked formerly for a trust company. She has been taking night school courses to qualify her as a loans officer. 6. 9. 15. 10. Peter has been taking additional courses in accounting and finance. 11. Two years ago they bought a home in the suburbs of Toronto. 12. The down payment on the home came partly from Registered Home Ownership Savings plans. The rest was advanced by Peter's father. 13. The purchase price of the home was $98,000. 14. The mortgage balance is presently $68,000. . Monthly mortgage payments, including taxes are $925. 16. Peter and Penny have two automobiles. Both are driven. 17. Peter's automobile is a recent model Chev Cavalier. Purchase price new was $13,500. 18. Monthly payments on the finance contract for Peter's car are $345. Balance owing on the contract is $7,500. 19. Penny's automobile is a six year old Chevette. Nothing is owing against it. 20. Penny's father used to play hockey for the Detroit Red Wings. 21. The company Peter works for has copyrighted some of their designs. They hope to sell these design rights in other countries under a licensing agreement. 22. Peter and Penny both belong to fitness/recreation clubs. 23. Peter hopes to buy recreational property in Muskoka. 24. Peter and Penny have three department store and two bank credit cards. The credit bureau reports payments on these generally good although there is occasional evidence of accounts running 30 days overdue. 25. They have just bought a new television and VCR which cost $1,200. They are paying this off at $100 a month. 10 Question 1 (con't) - ANSWERS CHARACTER CAPACITY: Financial CAPACITY: Intangible CAPITAL CONDITIONS IRRELEVANT 10 Question 1 (con't) - ANSWERS CHARACTER CAPACITY: Financial CAPACITY: Intangible CAPITAL CONDITIONS IRRELEVANT 28 26. Peter's company pays for its imports in U.S. dollars. 27. The company has just acquired the Canadian distribution rights for a line of high quality French-made poolside and patio furniture. 28. Peter and Penny are both gourmet cooks. They also dine out frequently at expensive restaurants, 29. Peter has a term insurance policy. His company pays his medial insurance and group insurance which includes disability. SUPPLY YOUR ANSWERS IN BOX CHART ON FOLLOWING PAGE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts