Question: 26 points, 2 points each Answer A or B or A-B for the following, Put your answer in the column to the right. Assume ALL

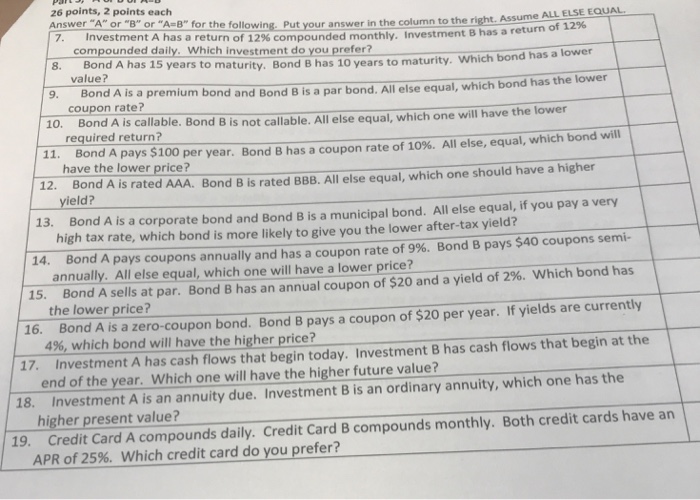

26 points, 2 points each Answer "A" or "B" or "A-B" for the following, Put your answer in the column to the right. Assume ALL ELSE EQUAL 7. Investment A has a return of 12% compounded monthly. Investment B has a return o f 12% compounded daily. Which investment do you prefer 8. Bond A has 15 years to maturity. Bond B has 10 years to maturity. Which bond has a lower value? a premium bond and Bond B is a par bond. All else equal, which bond has the lower coupon rate? d A is callable. Bond B is not callable. All else equal, which one will have the lower required return? - 11. Bond A 100per year.Bond Bhasacouponrate of10%. All else, equal, which bond will pays have the lower price? 12. Bond A is rated AAA. Bond B is rated 888. All else equal, which one should have a higher 13. Bond A is a corporate bond and Bond B is a municipal bond. All else equal, if you pay a very high tax rate, which bond is more likely to give you the lower after-tax yield? 14, Bond A pays coupons annually and has a coupon rate of 9%. Bond B pays $40 coupons semi annually. All else equal, which one will have a lower price? 15. Bond A sells at par. Bond B has an annual coupon of $20 and a yield of 296, which bond has the lower price? 16. Bond A is a zero-coupon bond. Bond B pays a coupon of $20 per year. If yields are currently 496, which bond will have the higher price? 17. Investment A has cash flows that begin today. Investment B has cash flows that begin at the nd of the year. Which one will have the higher future value? Investment A is an annuity due. Investment B is an ordinary annuity, which one has the 18. higher present value? 19. Credit Card A compounds daily. Credit Card B compounds monthly. Both credit cards have an APR of 25%, which credit card do you prefer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts