Question: 26) Purple Hedgehog Forestry is considering using more equity and less debt in its capil statements best describes 26 how this will affect the firm's

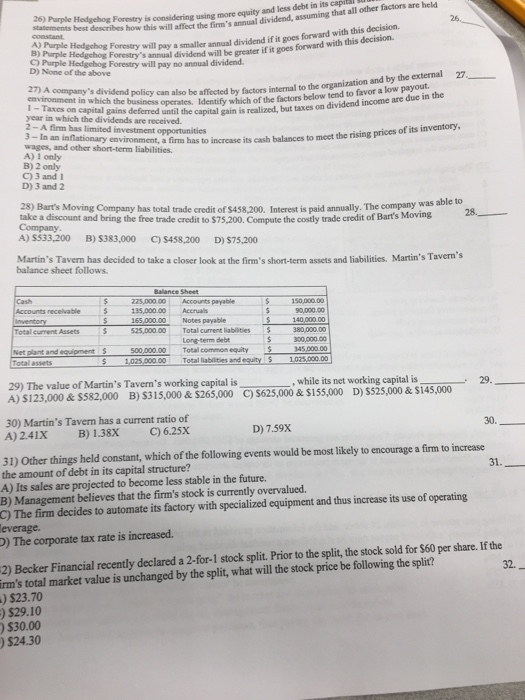

26) Purple Hedgehog Forestry is considering using more equity and less debt in its capil statements best describes 26 how this will affect the firm's annual dividend, assuming that all other factors are held will pay a smaller annual dividend if it goes forward with this decision. annual dividend will be greater if it goes forward with this decision A)Purple Hedgehog Forestry B) Purple Hedgehog Forestry's C) Purple Hedgehog Forestry will pay no annual dividend D) None of the above 27) environment in which the business A company's dividend policy can also be affected by factors internal to the organization ins deferesd oerates. Identify which of the factors below tend to favor a low payout. inthe deferred until the capital gain is realized, but taxes on dividend income are e year in which the dividends are received. 2-A firm has limited investment opportunities 3 - In an wages, and other short-term liabilities. A) 1 only ?) 2 only environment, a firm errm has to increase its cash balances to meet the rising prices of its inventory. C)3 and1 D) 3 and 2 28) Bart's Moving Company has total trade credit of $458,200. Interest is paid annually. The company was ake a discount and bring the free trade credit to $75,200. Compute the costly trade crodit of Barts A) S533,200 B) S383,000 C) $458.200 D)$75,200 able to Martin's Tavern has decided to take a closer look at the firm's short-term assets and liabilities. Martin's Tavern's balance sheet follows Balance Sheet 225,000.00 Accounts payable 135,000.00 Accruals 165,000.00 Notes payable 150,000.00 90,000.00 current Assets 525,000.00Total current liablities380,00000 Long-term debt 500,00000 Total common equity 345.000.00 1025.000.00Total liabilities and equity S 1025000.00 29) The value of Martin's Tavern's working capital is while its net working capital is 29 A) $123,000 & $582,000 B) S315,000 & S265,000 C) S625,000 & S155,000 D) $$25,000 & $145,000 30) Martin's Tavern has a current ratio of A)2.41x B 1.38x C)6.25x D) 7.59X 30. 31) Other things held constant, which of the following events would be most likely to encourage a firm to increase the amount of debt in its capital structure? A) Its sales are projected to become less stable in the future B) Management believes that the firm's stock is currently overvalued. C) The firm decides to automate its factory with specialized equipment and thus increase its use of operating everage O) The corporate tax rate is increased. 31 2) Becker Financial recently declared a 2-for-1 stock split. Prior to the split, the stock sold for $60 per share. If the irm's total market value is unchanged by the split, what will the stock price be following the split? ) $23.70 $29.10 $30.00 )$24.30 32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts