Question: 26. The Capital Asset Pricing Model implies that A The expected rate of return is inversely proportional to beta 8. If an investment had a

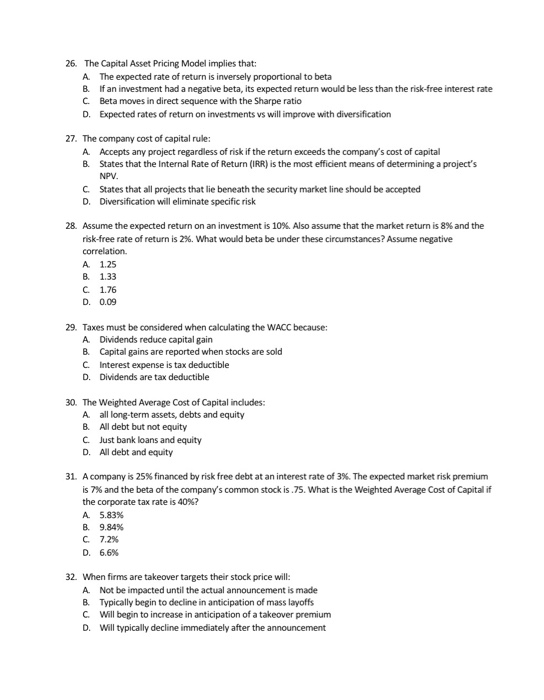

26. The Capital Asset Pricing Model implies that A The expected rate of return is inversely proportional to beta 8. If an investment had a negative beta, its expected return would be less than the risk-free interest rate C. Beta moves in direct sequence with the Sharpe ratio D. Expected rates of return on investments vs will improve with diversification 27. The company cost of capital rule: A Accepts any project regardless of risk if the return exceeds the company's cost of capital B. States that the Internal Rate of Return (IRR) is the most efficient means of determining a project's C. D. NPV. States that all projects that lie beneath the security market line should be accepted Diversification will eliminate specific risk 28, Assume the expected return on an investment is 10%. Also assume that the market return is 8% and the risk-free rate of return is 2%, what would beta be under these circumstances? Assume negative A. 1.25 8 1.33 C. 1.76 D. 0.09 29. Taxes must be considered when calculating the WACC because: A B. C. D. Dividends reduce capital gain Capital gains are reported when stocks are sold Interest expense is tax deductible Dividends are tax deductible 30. The Weighted Average Cost of Capital indudes: A B. C. D. all long-term assets, debts and equity All debt but not equity Just bank loans and equity All debt and equity 31 A company is 25% financed by risk free debt at an interest rate of 3%. The expected market risk premium is 7% and the beta of the company's common stock is .75. What is the Weighted Average Cost of Capital if the corporate tax rate is 40%? A 5.83% B. 9.84% C. 7.2% D. 6.6% 32. When firms are takeover targets their stock price will A. Not be impacted until the actual announcement is made B. Typically begin to decline in anticipation of mass layoffs C. Will begin to increase in anticipation of a takeover premium D. Will typically decline immediately after the announcement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts