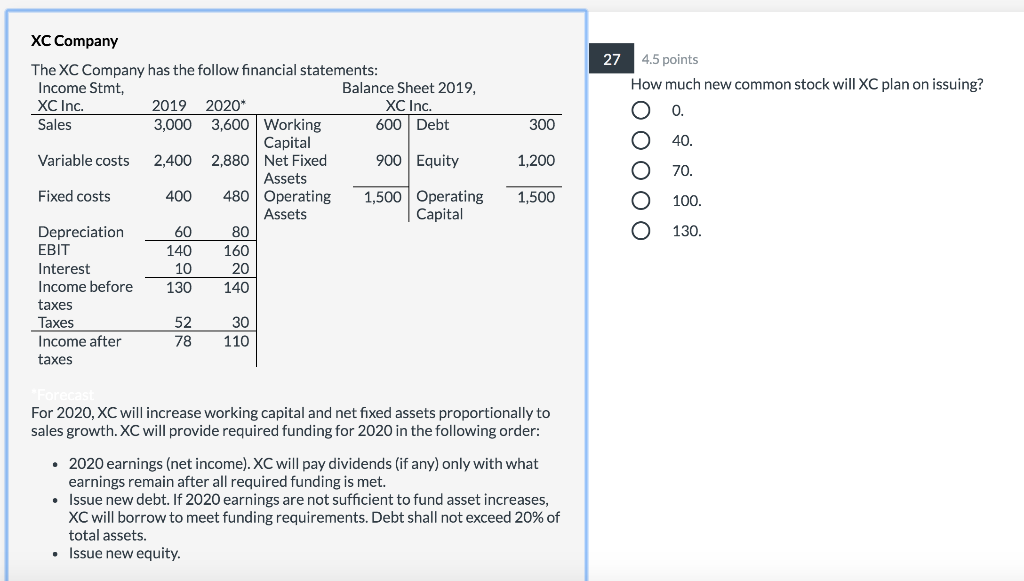

Question: 27 4.5 points How much new common stock will XC plan on issuing? 0. 300 40. 1,200 70. XC Company The XC Company has the

27 4.5 points How much new common stock will XC plan on issuing? 0. 300 40. 1,200 70. XC Company The XC Company has the follow financial statements: Income Stmt, Balance Sheet 2019, XC Inc. 2019 2020* XC Inc. Sales 3,000 3,600 Working 600 Debt Capital Variable costs 2,400 2,880 Net Fixed 900 Equity Assets Fixed costs 400 480 Operating 1,500 Operating Assets Capital Depreciation 60 80 EBIT 140 160 Interest 10 20 Income before 130 140 taxes Taxes 52 30 Income after 78 110 taxes 1,500 100. 130. For 2020, XC will increase working capital and net fixed assets proportionally to sales growth. XC will provide required funding for 2020 in the following order: 2020 earnings (net income). XC will pay dividends (if any) only with what earnings remain after all required funding is met. Issue new debt. If 2020 earnings are not sufficient to fund asset increases, XC will borrow to meet funding requirements. Debt shall not exceed 20% of total assets. Issue new equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts