Question: 27. During 2018, Jay Baker was granted a divorce from his wife. The divorce decree stipulated that he was to pay both alimony and child

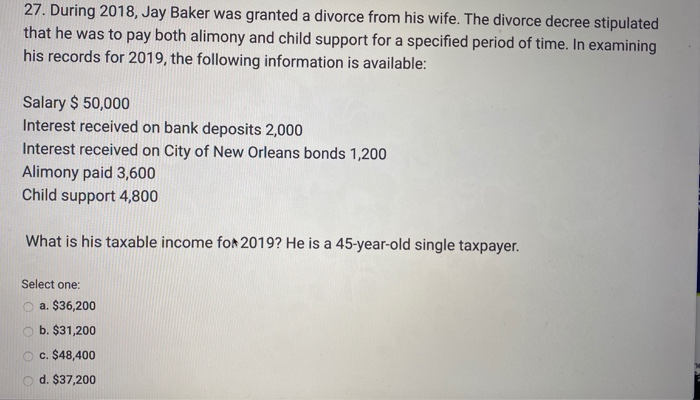

27. During 2018, Jay Baker was granted a divorce from his wife. The divorce decree stipulated that he was to pay both alimony and child support for a specified period of time. In examining his records for 2019, the following information is available: Salary $50,000 Interest received on bank deposits 2,000 Interest received on City of New Orleans bonds 1,200 Alimony paid 3,600 Child support 4,800 What is his taxable income fo 2019? He is a 45-year-old single taxpayer. Select one: a. $36,200 b. $31,200 c. $48,400 d. $37,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts