Question: 27) If the expected return on Treasury securities is 7 percent, the expected return on the market portfolio is 10 percent, and the beta of

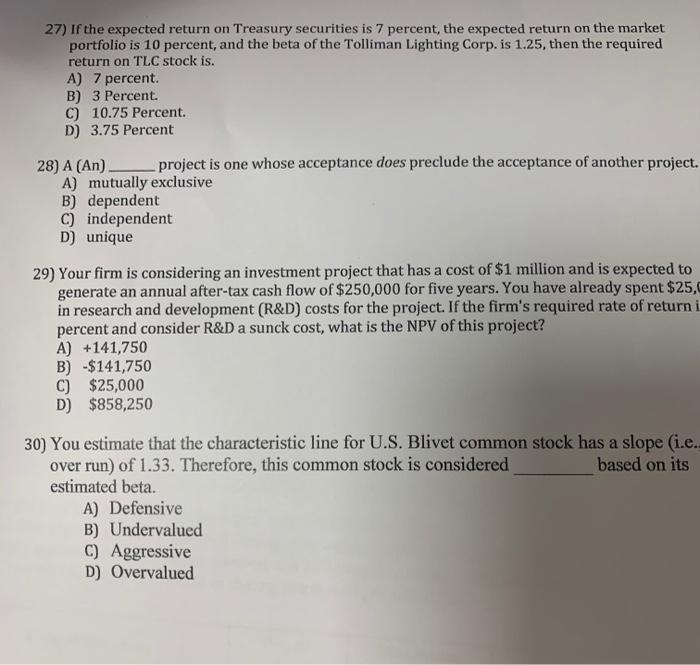

27) If the expected return on Treasury securities is 7 percent, the expected return on the market portfolio is 10 percent, and the beta of the Tolliman Lighting Corp. is 1.25, then the required return on TLC stock is. A) 7 percent. B) 3 Percent. C) 10.75 Percent. D) 3.75 Percent 28) A (An) project is one whose acceptance does preclude the acceptance of another project. A) mutually exclusive B) dependent C) independent D) unique 29) Your firm is considering an investment project that has a cost of $1 million and is expected to generate an annual after-tax cash flow of $250,000 for five years. You have already spent $25, in research and development (R\&D) costs for the project. If the firm's required rate of return i percent and consider R\&D a sunck cost, what is the NPV of this project? A) +141,750 B) $141,750 C) $25,000 D) $858,250 30) You estimate that the characteristic line for U.S. Blivet common stock has a slope (i.e. over run) of 1.33. Therefore, this common stock is considered based on its estimated beta. A) Defensive B) Undervalued C) Aggressive D) Overvalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts