Question: 27. In each succeeding payment on an installment note A) The amounts paid for both interest and principal increase proportionately B) The amount of principal

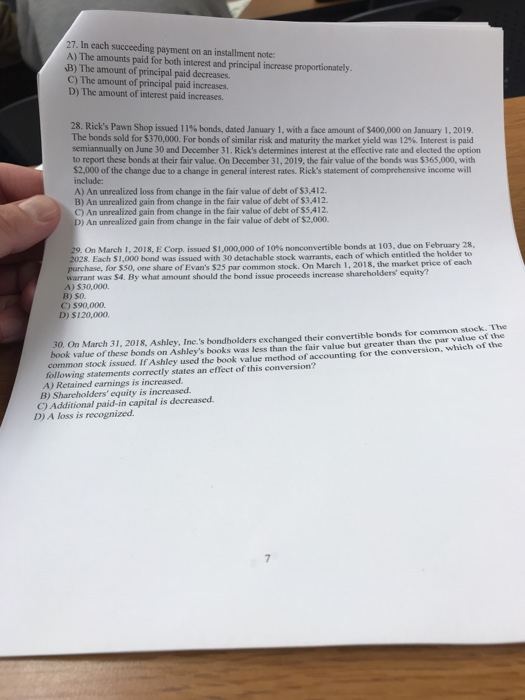

27. In each succeeding payment on an installment note A) The amounts paid for both interest and principal increase proportionately B) The amount of principal paid decreases. C) The amount of principal paid increases D) The amount of interest paid increases. 28. Rick's Pawn shop issued i 1% bonds, dated January l. with a face amount of $400,000 on January 1, 2019 The bonds sold for $370,000. For bonds of similar risk and maturity the market yield was 12% Interest is paid semiannually on June 30 and December 31. Rick's determines interest at the effective rate and elected the option to report these bonds at their fair value. On December 31, 2019, the fair value of the bonds was $365,000, with $2,000 of the change due to a change in general interest rates. Rick's statement of comprchensive income will include: A) An unrealized loss from change in the fair value of debt of $3,412. B) An unrealized gain from change in the fair value of debt of $3,412 C) An unrealized gain from change in the fair value of debt of $5,412 An unrealized gain from change in the fair value of debt of $2,000. On March 1, 2018, E Corp. issued $1,000,000 of 10% no convertible bonds at 103, de r February 28, 2028. Each $1,000 bond was issued with 30 detachable stock warrants, each of which entitled the holder to purchase, for $50, one share of Evan's $25 par common stock. On March 1. 2018, the market price increase shareholders' equity? A) $30,000. B) SO. C) 590,000. D) $120,000 30. On March 31, 2018, Ashley, Ine.'s bondholders exchanged their convertible bonds for common stock. The book value of these bonds on Ashley's books was less than the fair value but greater than the par value of the common stock issued. If Ashley used the book value method of accounting for the conversion, which ot the following statements correetly states an effect of this conversion? A) Retained carnings is increased. B) Shareholders' equity is increased C) Additional paid-in capital is decreased. D) A loss is recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts