Question: 27 Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected the project will produce the following cash flows for

27

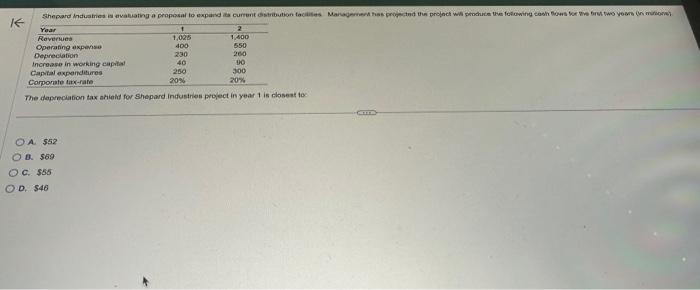

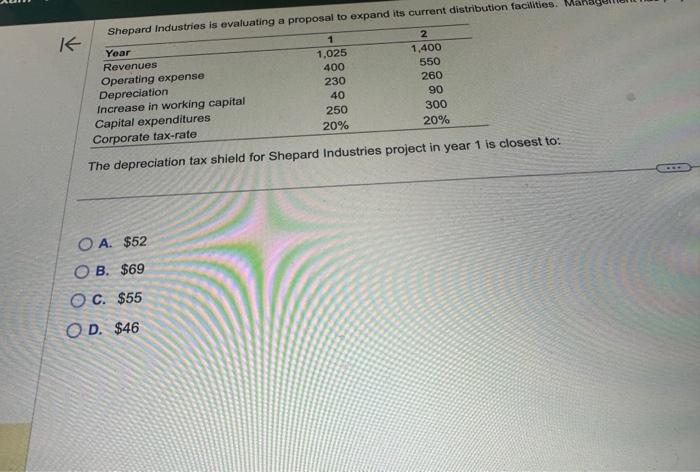

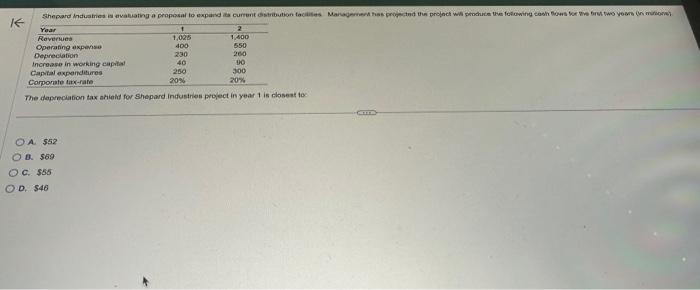

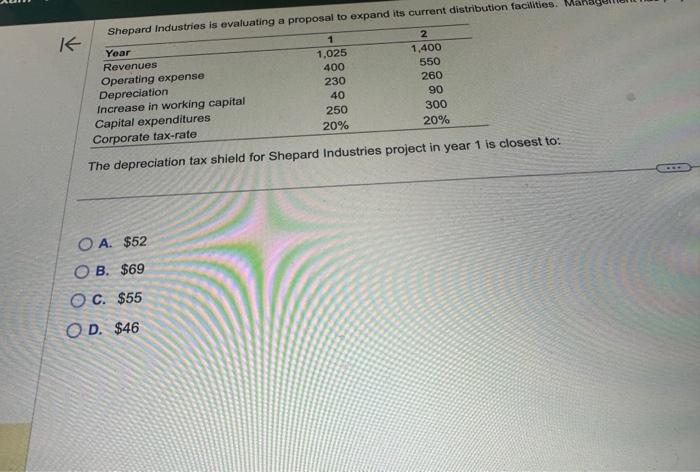

Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected the project will produce the following cash flows for the first two years (in millions)

K

Year

Revenues

Operating expense

Depreciation

Increase in working capital

Capital expenditures

Corporate tax-rate

1

1,025

400

230

40

250

20%

1,400

550

260

90

300

20%

The depreciation tax shield for Shepard Industries project in year 1 is closest to:

- A. $52

- B. $69

O c. $55

O D. $46

The dapenciabion tax ahield for shepard industries profect in year 1 is closeat to. A. $52 D. 569 c. 585 D. $4 A. $52 B. $69 C. $55 D. $46

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock