Question: 27. The projected cash flows (including reversion) are shown below for property A and property B. (5pts) a. Assuming you can buy both properties at

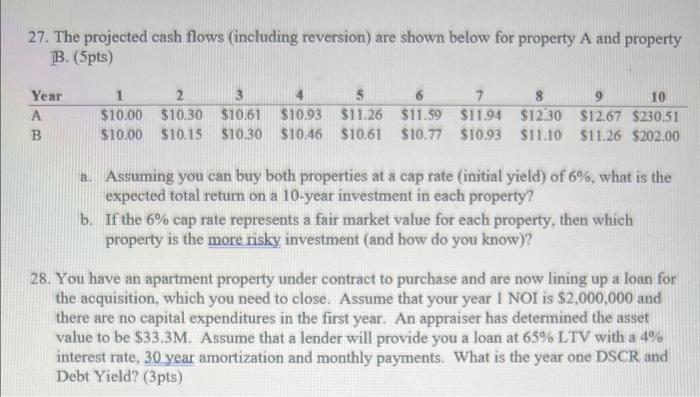

27. The projected cash flows (including reversion) are shown below for property A and property B. (5pts) a. Assuming you can buy both properties at a cap rate (initial yield) of 6%, what is the expected total return on a 10-year investment in each property? b. If the 6% cap rate represents a fair market value for each property, then which property is the more risky investment (and how do you know)? 28. You have an apartment property under contract to purchase and are now lining up a loan for the acquisition, which you need to close. Assume that your year 1 NOI is $2,000,000 and there are no capital expenditures in the first year. An appraiser has determined the asset value to be $33.3M. Assume that a lender will provide you a loan at 65% LTV with a 4% interest rate, 30 year amortization and monthly payments. What is the year one DSCR and Debt Yield? (3pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts