Question: 27. The standard deviation is often used by finance managers in the financial markets to measure the risk of their investment in shares or their

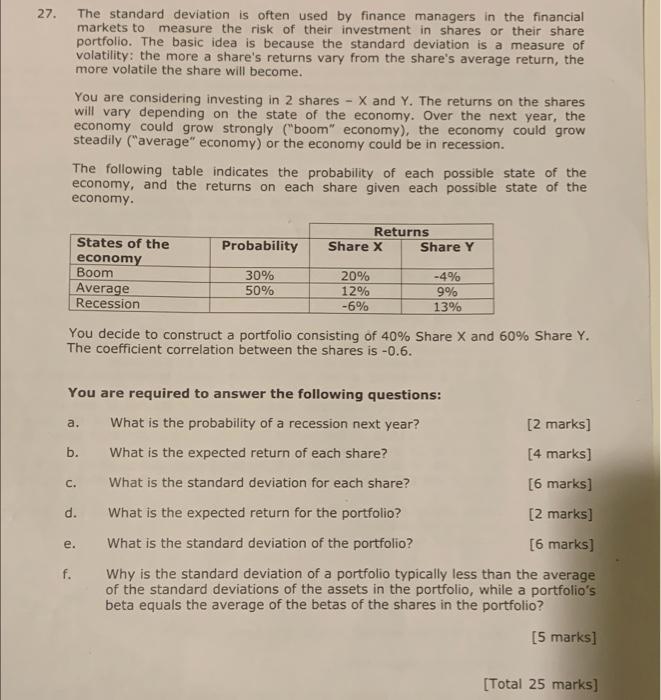

27. The standard deviation is often used by finance managers in the financial markets to measure the risk of their investment in shares or their share portfolio. The basic idea is because the standard deviation is a measure of volatility: the more a share's returns vary from the share's average return, the more volatile the share will become. You are considering investing in 2 shares - X and Y. The returns on the shares will vary depending on the state of the economy. Over the next year, the economy could grow strongly ("boom" economy), the economy could grow steadily ("average" economy) or the economy could be in recession. The following table indicates the probability of each possible state of the economy, and the returns on each share given each possible state of the economy. Probability Returns Share X Share Y States of the economy Boom Average Recession 30% 50% 20% 12% -6% -4% 9% 13% You decide to construct a portfolio consisting of 40% Share X and 60% Share Y. The coefficient correlation between the shares is -0.6. a. c. You are required to answer the following questions: What is the probability of a recession next year? [2 marks] b. What is the expected return of each share? [4 marks] What is the standard deviation for each share? [6 marks] d. What is the expected return for the portfolio? [2 marks] What is the standard deviation of the portfolio? [6 marks] f. Why is the standard deviation of a portfolio typically less than the average of the standard deviations of the assets in the portfolio, while a portfolio's beta equals the average of the betas of the shares in the portfolio? [5 marks] e. [Total 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts