Question: 27. value 8.00 points Problem 15-13 Flotation Costs (LO2) Young Corporation stock currently sells for $24 per share. There are one million shares currently outstanding.

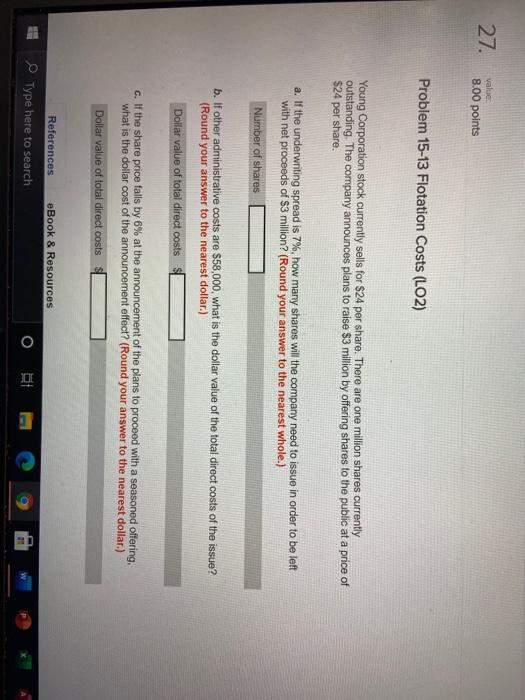

27. value 8.00 points Problem 15-13 Flotation Costs (LO2) Young Corporation stock currently sells for $24 per share. There are one million shares currently outstanding. The company announces plans to raise $3 million by offering shares to the public at a price of $24 per share. a. If the underwriting spread is 7%, how many shares will the company need to issue in order to be left with net proceeds of $3 million? (Round your answer to the nearest whole.) Number of shares b. If other administrative costs are $58,000, what is the dollar value of the total direct costs of the issue? (Round your answer to the nearest dollar.) Dollar value of total direct costs c. If the share price falls by 6% at the announcement of the plans to proceed with a seasoned offering, what is the dollar cost of the announcement effect? (Round your answer to the nearest dollar.) Dollar value of total direct costs References eBook & Resources Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts