Question: 27. What is the expected operating cash flow for year 2 of a project given the following information. To undertake the project, $326,000 must be

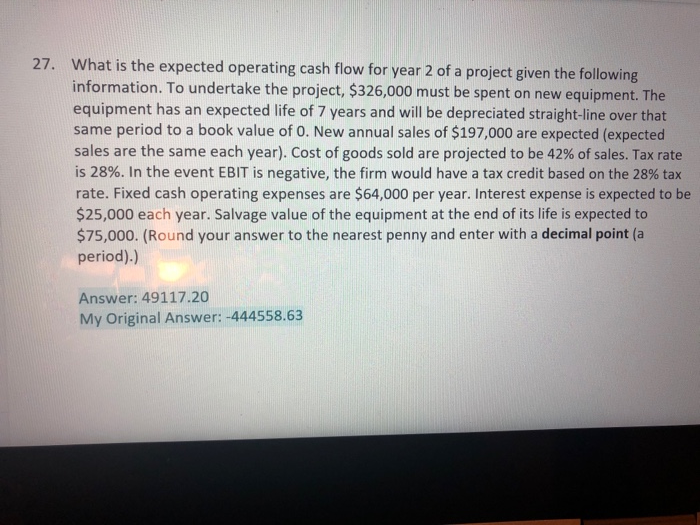

27. What is the expected operating cash flow for year 2 of a project given the following information. To undertake the project, $326,000 must be spent on new equipment. The equipment has an expected life of 7 years and will be depreciated straight-line over that same period to a book value of 0. New annual sales of $197,000 are expected (expected sales are the same each year). Cost of goods sold are projected to be 42% of sales. Tax rate is 28%. In the event EBIT is negative, the firm would have a tax credit based on the 28% tax rate. Fixed cash operating expenses are $64,000 per year. Interest expense is expected to be $25,000 each year. Salvage value of the equipment at the end of its life is expected to $75,000. (Round your answer to the nearest penny and enter with a decimal point (a period).) Answer: 49117.20 My Original Answer: -444558.63

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts