Question: 27 . Which item (s ) can be deducted by Austin as a business expense ? ( Select all that apply . ) a .

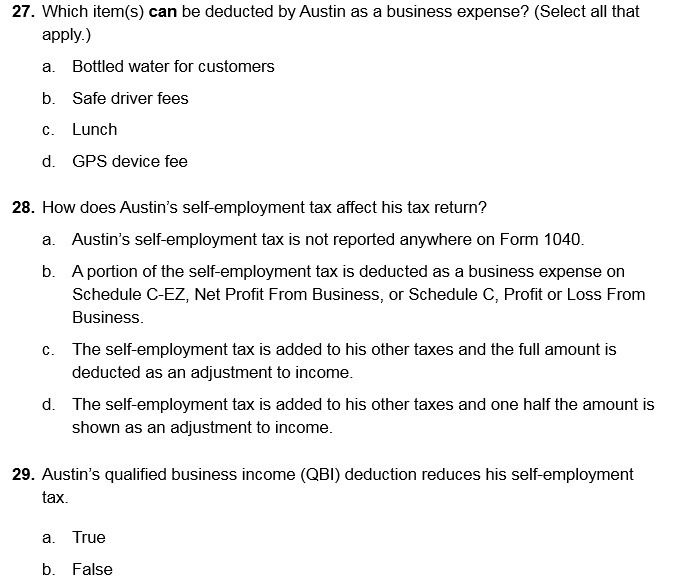

27 . Which item (s ) can be deducted by Austin as a business expense ? ( Select all that apply . ) a . Bottled water for customers b . Safe driver fees C. Lunch d . GPS device fee 28 . How does Austin's self employment tax affect his tax return ? a . Austin's self -employment tax is not reported anywhere on Form 1040 b . A portion of the self -employment tax is deducted as a business expense on Schedule C -EZ . Net Profit From Business . or Schedule C . Profit or Loss From Business C . The self employment tax is added to his other taxes and the full amount is deducted as an adjustment to income d . The self - employment tax is added to his other taxes and one half the amount is shown as an adjustment to income 29 . Austin's qualified business income ( QB! ) deduction reduces his self employment tax a . True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts