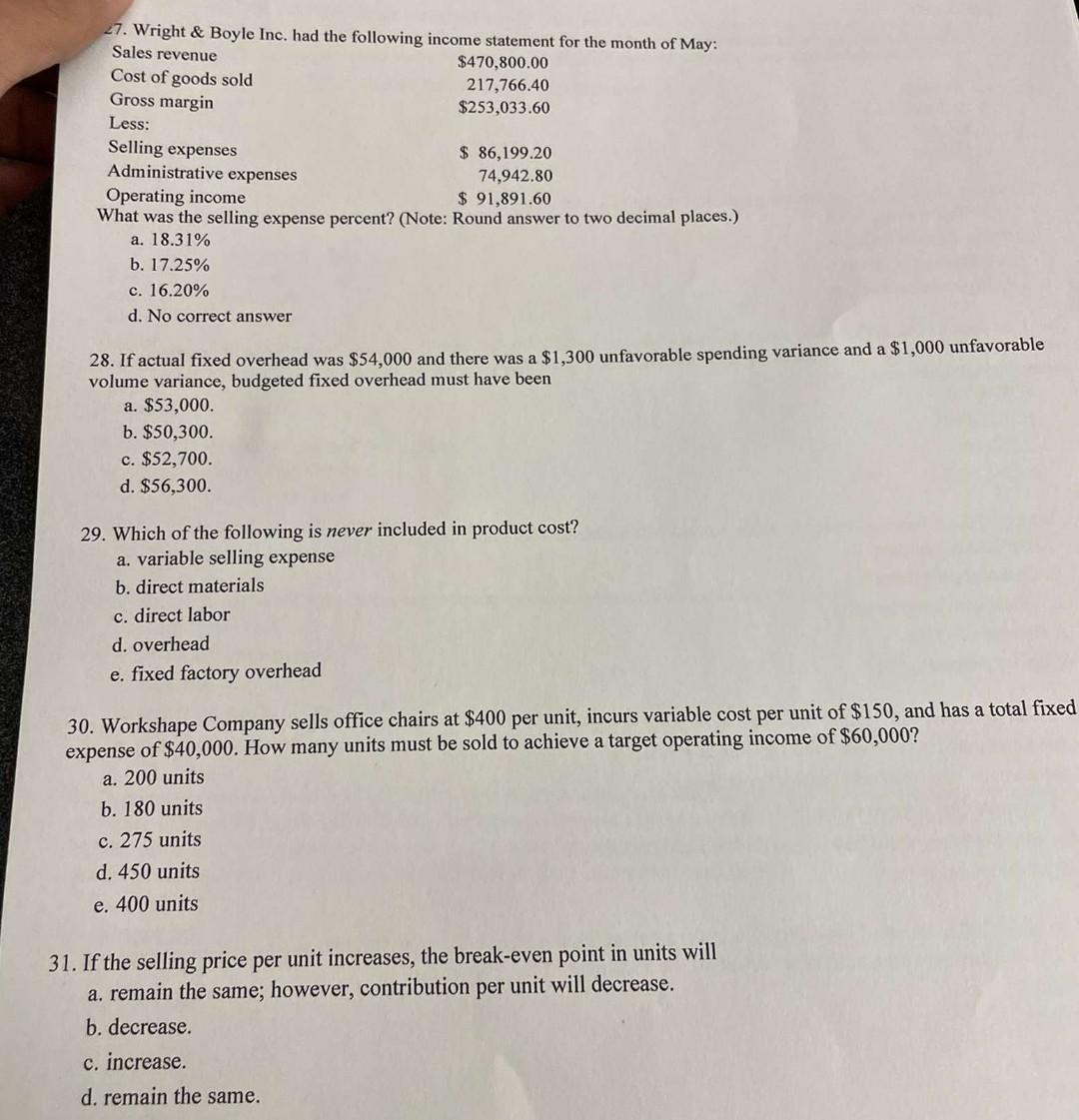

Question: 27. Wright & Boyle Inc. had the following income statement for the month of May: Sales revenue $470,800.00 Cost of goods sold 217,766.40 Gross margin

27. Wright & Boyle Inc. had the following income statement for the month of May: Sales revenue $470,800.00 Cost of goods sold 217,766.40 Gross margin $253,033.60 Less: Selling expenses $ 86,199.20 Administrative expenses 74,942.80 Operating income $ 91,891.60 What was the selling expense percent? (Note: Round answer to two decimal places.) a. 18.31% b. 17.25% c. 16.20% d. No correct answer 28. If actual fixed overhead was $54,000 and there was a $1,300 unfavorable spending variance and a $1,000 unfavorable volume variance, budgeted fixed overhead must have been a. $53,000. b. $50,300. c. $52,700. d. $56,300. 29. Which of the following is never included in product cost? a. variable selling expense b. direct materials c. direct labor d. overhead e. fixed factory overhead 30. Workshape Company sells office chairs at $400 per unit, incurs variable cost per unit of $150, and has a total fixed expense of $40,000. How many units must be sold to achieve a target operating income of $60,000? a. 200 units b. 180 units c. 275 units d. 450 units e. 400 units 31. If the selling price per unit increases, the break-even point in units will a. remain the same; however, contribution per unit will decrease. b. decrease. c. increase. d. remain the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts