Question: 27. You are getting ready to prepare pro forma statements for your business. Which one of the following are you most apt to estimate first

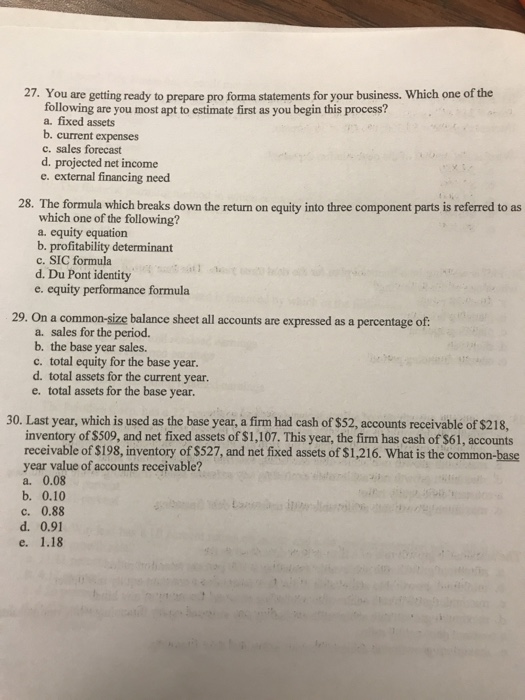

27. You are getting ready to prepare pro forma statements for your business. Which one of the following are you most apt to estimate first as you begin this process? a. fixed assets b. current expenses c. sales forecast d. projected net income e. external financing need 28. The formula which breaks down the return on equity into three component parts is referred to as which one of the following? a. equity equation b. profitability determinant c. SIC formula d. Du Pont identity e. equity performance formula 29. On a common-size balance sheet all accounts are expressed as a percentage of: a. sales for the period. b. the base year sales. c. total equity for the base year. d. total assets for the current year. e. total assets for the base year. 30. Last year, which is used as the base year, a firm had cash of $52, accounts receivable of $218, inventory of $509, and net fixed assets of $1,107. This year, the firm has cash of $61, accounts receivable of $198, inventory of $527, and net fixed assets of $1,216. What is the common-base year value of accounts receivable? a. 0.08 b. 0.10 c. 0.88 d. 0.91 e. 1.18 La

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts