Question: 272 Chapter 6 Problem 3 (Cash Flow from Operating Activities) Bleu Company's income statement for the year ended December 31, 2018, is as follows: Bleu

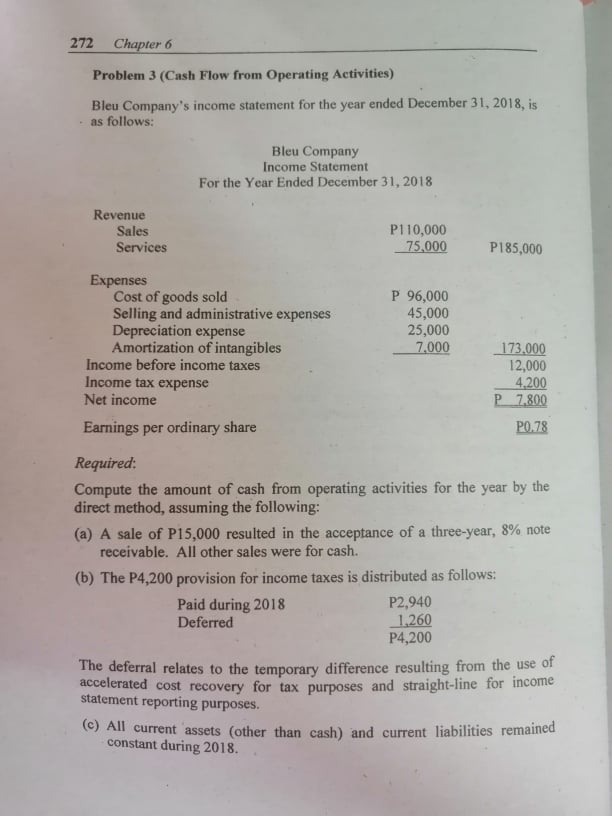

272 Chapter 6 Problem 3 (Cash Flow from Operating Activities) Bleu Company's income statement for the year ended December 31, 2018, is as follows: Bleu Company Income Statement For the Year Ended December 31, 2018 Revenue Sales P1 10,000 Services 75,000 P185,000 Expenses Cost of goods sold P 96,000 Selling and administrative expenses 45,000 Depreciation expense 25,000 Amortization of intangibles 7,000 173,000 Income before income taxes 12,000 Income tax expense 4,200 Net income P 7,800 Earnings per ordinary share PO.78 Required: Compute the amount of cash from operating activities for the year by the direct method, assuming the following: (a) A sale of P15,000 resulted in the acceptance of a three-year, 8% note receivable. All other sales were for cash. (b) The P4,200 provision for income taxes is distributed as follows: Paid during 2018 P2,940 Deferred 1,260 P4,200 The deferral relates to the temporary difference resulting from the use of accelerated cost recovery for tax purposes and straight-line for income statement reporting purposes. (c) All current assets (other than cash) and current liabilities remained constant during 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts