Question: 27.Which of the DCF based valuation methodologies use the weighted average cost of capital as the discount factor? a-Adjusted present value and enterprise DCE b-Discounted

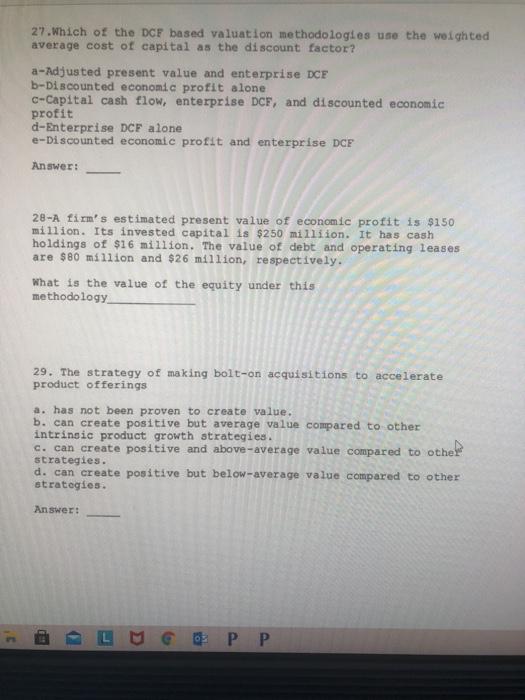

27.Which of the DCF based valuation methodologies use the weighted average cost of capital as the discount factor? a-Adjusted present value and enterprise DCE b-Discounted economic profit alone C-Capital cash flow, enterprise DCF, and discounted economic profit d-Enterprise DCF alone e-Discounted economic profit and enterprise DCE Answer: 28-A firm's estimated present value of economic profit is $150 million. Its invested capital is $250 million. It has cash holdings of $16 million. The value of debt and operating leases are $80 million and $26 million, respectively. What is the value of the equity under this methodology 29. The strategy of making bolt-on acquisitions to accelerate product offerings a. has not been proven to create value. b. can create positive but average value compared to other c. can create positive and above-average value compared to other strategies. d. can create positive but below-average value compared to other strategies. Answer: 09 MGPP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts