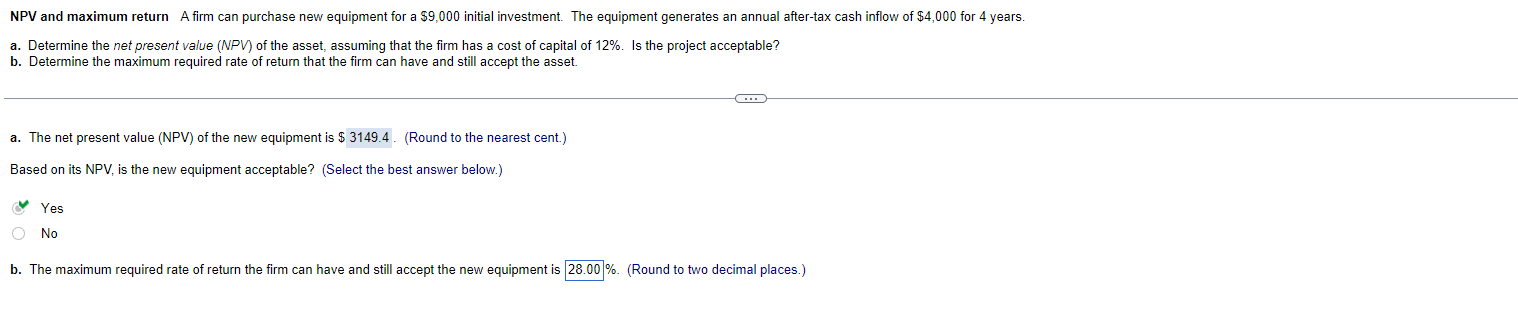

Question: 28% is incorrect.. NPV and maximum return A firm can purchase new equipment for a $9,000 initial investment. The equipment generates an annual after-tax cash

28% is incorrect..

28% is incorrect..

NPV and maximum return A firm can purchase new equipment for a $9,000 initial investment. The equipment generates an annual after-tax cash inflow of $4,000 for 4 years. a. Determine the net present value (NPV) of the asset, assuming that the firm has a cost of capital of 12%. Is the project acceptable? b. Determine the maximum required rate of return that the firm can have and still accept the asset. C a. The net present value (NPV) of the new equipment is $3149.4. (Round to the nearest cent.) Based on its NPV, is the new equipment acceptable? (Select the best answer below.) Yes O No b. The maximum required rate of return the firm can have and still accept the new equipment is 28.00%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts