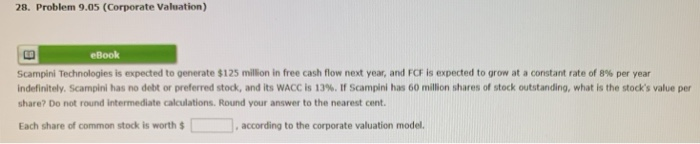

Question: 28. Problem 9.05 (Corporate Valuation) eBook Scampini Technologies is expected to generate $125 million in free cash flow next year, and FCF is expected to

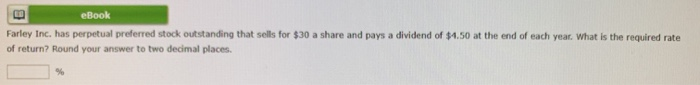

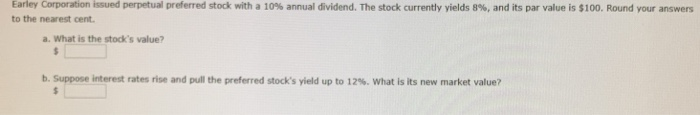

28. Problem 9.05 (Corporate Valuation) eBook Scampini Technologies is expected to generate $125 million in free cash flow next year, and FCF is expected to grow at a constant rate of 8% per year indefinitely. Scampini has no debt or preferred stock, and its WACC is 13%. If Scampini has 60 million shares of stock outstanding, what is the stock's value per share? Do not round Intermediate calculations. Round your answer to the nearest cent. Each share of common stock is worth $ according to the corporate valuation model. LO eBook Farley Inc. has perpetual preferred stock outstanding that sells for $30 a share and pays a dividend of $1.50 at the end of each year. What is the required rate of return? Round your answer to two decimal places Earley Corporation issued perpetual preferred stock with a 10% annual dividend. The stock currently yields 8%, and its par value is $100. Round your answers to the nearest cent. a. What is the stock's value? $ b. Suppose interest rates rise and pull the preferred stock's yield up to 12%. What is its new market value? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts