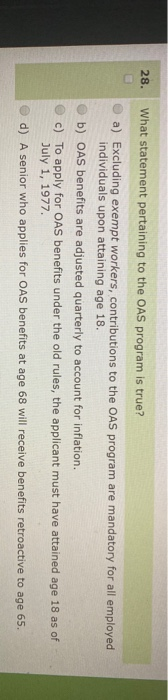

Question: 28. What statement pertaining to the OAS program is true? a) Excluding exempt workers, contributions to the OAS program are mandatory for all employed individuals

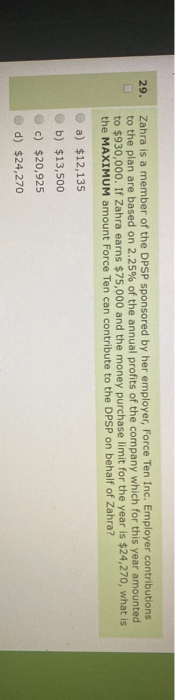

28. What statement pertaining to the OAS program is true? a) Excluding exempt workers, contributions to the OAS program are mandatory for all employed individuals upon attaining age 18. b) OAS benefits are adjusted quarterly to account for inflation. c) To apply for OAS benefits under the old rules, the applicant must have attained age 18 as of July 1, 1977. d) A senior who applies for OAS benefits at age 68 will receive benefits retroactive to age 65. 29. Zahra is a member of the DPSP sponsored by her employer, Force Ten Inc. Employer contributions to the plan are based on 2.25% of the annual profits of the company which for this year amounted to $930,000. If Zahra earns $75,000 and the money purchase limit for the year is $24,270, what is the MAXIMUM amount Force Ten can contribute to the DPSP on behalf of Zahra? a) $12,135 b) $13,500 c) $20,925 d) $24,270

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts