Question: 28,29 read 27 clearfully you get it 28. What is the value/ share of question #27 using the Free Cash Flow Model? 29. Beyond Meat

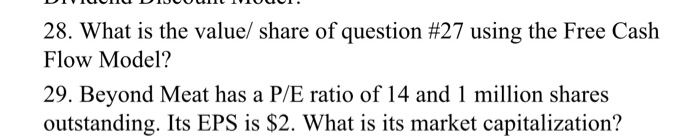

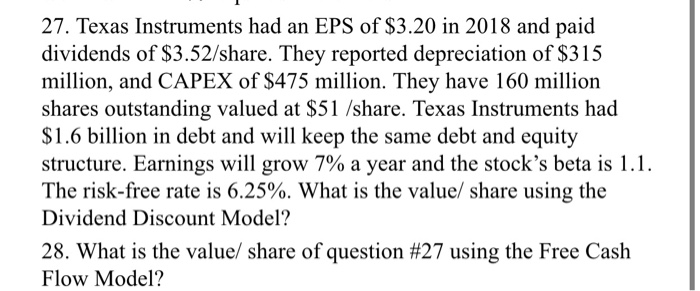

28. What is the value/ share of question #27 using the Free Cash Flow Model? 29. Beyond Meat has a P/E ratio of 14 and 1 million shares outstanding. Its EPS is $2. What is its market capitalization? 27. Texas Instruments had an EPS of $3.20 in 2018 and paid dividends of $3.52/share. They reported depreciation of $315 million, and CAPEX of $475 million. They have 160 million shares outstanding valued at $51 /share. Texas Instruments had $1.6 billion in debt and will keep the same debt and equity structure. Earnings will grow 7% a year and the stocks beta is 1.1. The risk-free rate is 6.25%. What is the value/ share using the Dividend Discount Model? 28. What is the value/ share of question #27 using the Free Cash Flow Model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts