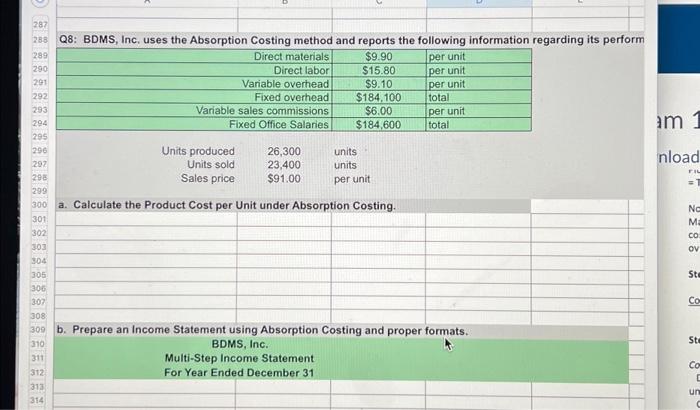

Question: 287 288 Q8: BDMS, Inc. uses the Absorption Costing method and reports the following information regarding its perform Direct materials $9.90 Direct labor $15.80 Variable

287 288 Q8: BDMS, Inc. uses the Absorption Costing method and reports the following information regarding its perform Direct materials $9.90 Direct labor $15.80 Variable overhead $9.10 Fixed overhead $184,100 $6.00 Variable sales commissions Fixed Office Salaries $184,600 289 290 291 292 293 294 295 296 297 298 299 300 a. Calculate the Product Cost per Unit under Absorption Costing. 301 302 303 304 305 306 307 308 309 b. Prepare an Income Statement using Absorption Costing and proper formats. 310 311 312 313 314 Units produced Units sold Sales price 26,300 23,400 $91.00 BDMS, Inc. Multi-Step Income Statement For Year Ended December 31 units units per unit per unit per unit per unit total per unit total am 1 nload ril = 1 No Ma CO: OV Ste Co Ste Co C un

Q8: BDMS, Inc. uses the Absorption Costing method and reports the following information regarding its perform a. Calculate the Product Cost per Unit under Absorption Costing. b. Prepare an Income Statement using Absorption Costing and proper formats. BDMS, Inc. Multi-Step Income Statement For Year Ended December 31

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock