Question: 29) 29) The bank statement reveals an EFT received from a customer that has not yet been recorded in the journal. How would this information

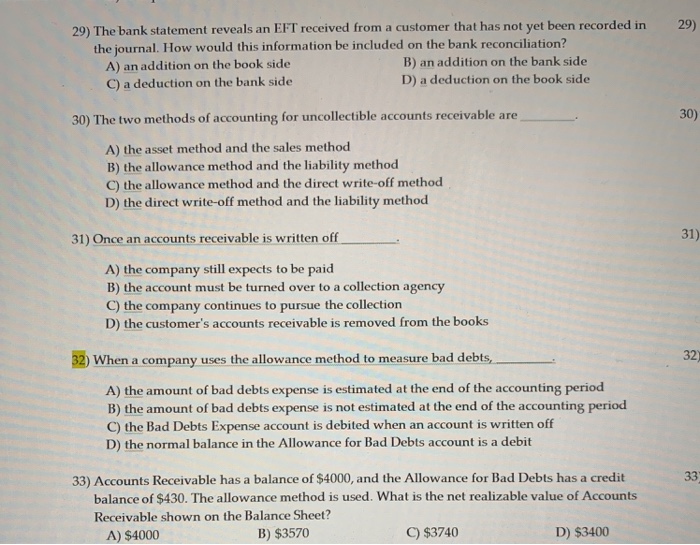

29) 29) The bank statement reveals an EFT received from a customer that has not yet been recorded in the journal. How would this information be included on the bank reconciliation? A) an addition on the book side B) an addition on the bank side C) a deduction on the bank side D) a deduction on the book side 30) The two methods of accounting for uncollectible accounts receivable are 30) A) the asset method and the sales method B) the allowance method and the liability method C) the allowance method and the direct write-off method D) the direct write-off method and the liability method 31) Once an accounts receivable is written off A) the company still expects to be paid B) the account must be turned over to a collection agency C) the company continues to pursue the collection D) the customer's accounts receivable is removed from the books 32) When a company uses the allowance method to measure bad debts, 32 A) the amount of bad debts expense is estimated at the end of the accounting period B) the amount of bad debts expense is not estimated at the end of the accounting period C) the Bad Debts Expense account is debited when an account is written off D) the normal balance in the Allowance for Bad Debts account is a debit 33 33) Accounts Receivable has a balance of $4000, and the Allowance for Bad Debts has a credit balance of $430. The allowance method is used. What is the net realizable value of Accounts Receivable shown on the Balance Sheet? A) $4000 B) $3570 C) $3740 D) $3400 D) 00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts