Question: 29 48 57 Saved Question 29 (3 points) Listen Your father's employer was just acquired, and he was given a severance payment of $342,500, which

29

48

57

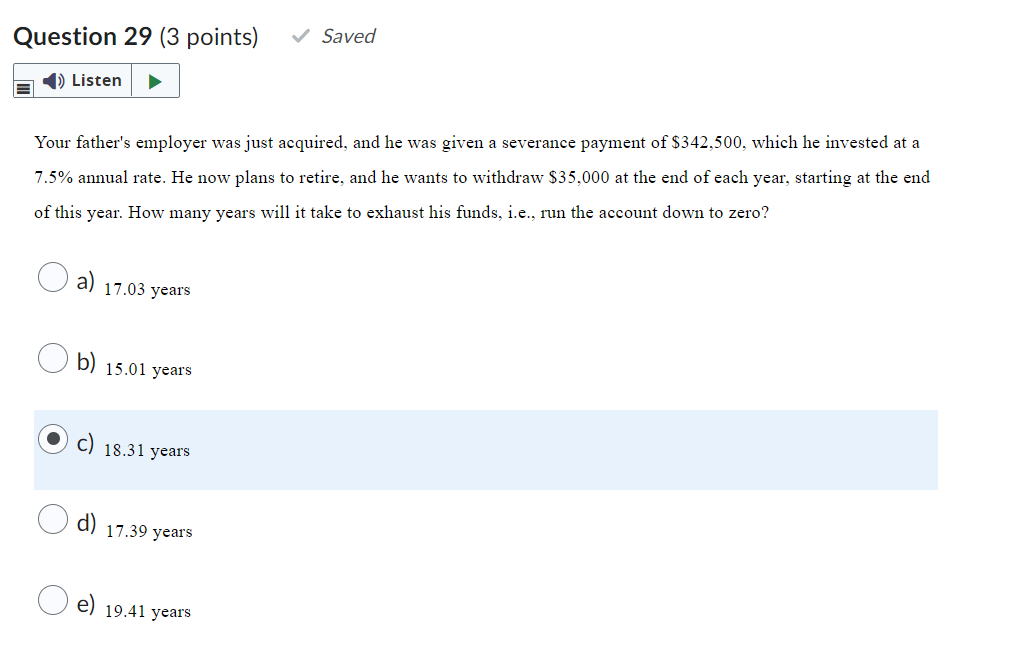

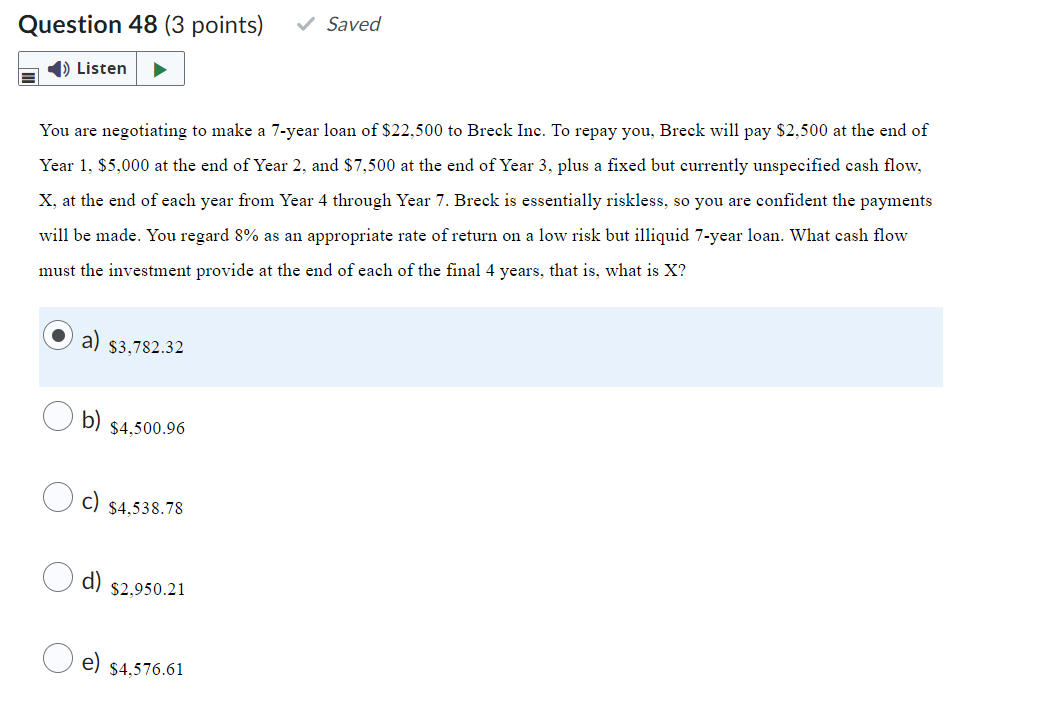

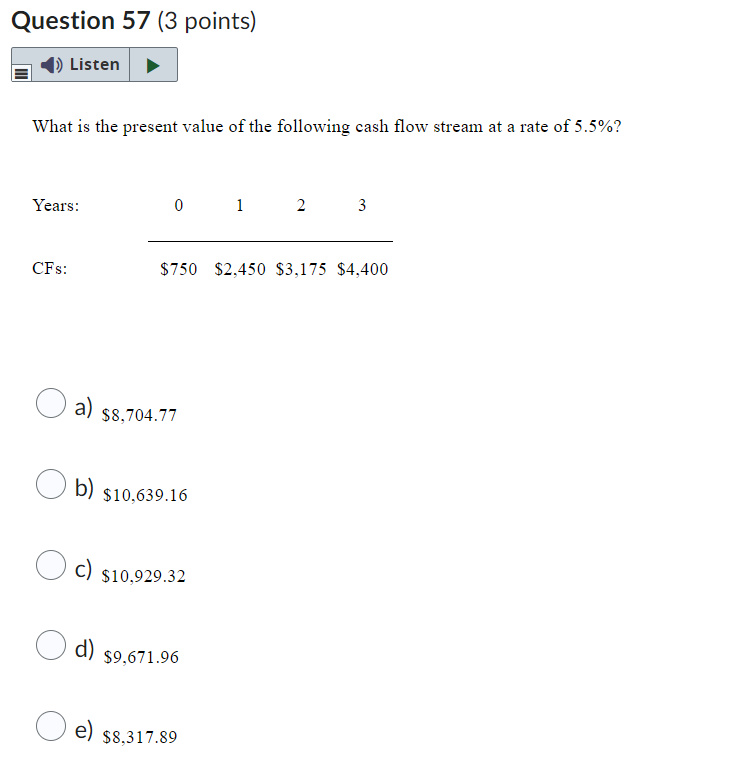

Saved Question 29 (3 points) Listen Your father's employer was just acquired, and he was given a severance payment of $342,500, which he invested at a 7.5% annual rate. He now plans to retire, and he wants to withdraw $35,000 at the end of each year, starting at the end of this year. How many years will it take to exhaust his funds, i.e., run the account down to zero? a) 17.03 years b) 15.01 years C) 18.31 years d) 17.39 years 19.41 years Saved Question 48 (3 points) ) Listen You are negotiating to make a 7-year loan of $22,500 to Breck Inc. To repay you, Breck will pay $2,500 at the end of Year 1, $5,000 at the end of Year 2, and $7,500 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Breck is essentially riskless, so you are confident the payments will be made. You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X? $3,782.32 b) $4.500.96 c) $4,538.78 d) $2,950.21 e) $4.576.61 Question 57 (3 points) Listen What is the present value of the following cash flow stream at a rate of 5.5%? Years: 0 1 2 3 CFS: $750 $2,450 $3,175 $4,400 a) $8,704.77 O b) $10,639.16 $10,929.32 d) $9,671.96 e) $8,317.89 O c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts