Question: 29. A protective covenant may a specify all the rights and obligations of the issuing firm and the bondholders. b. require the firm to retire

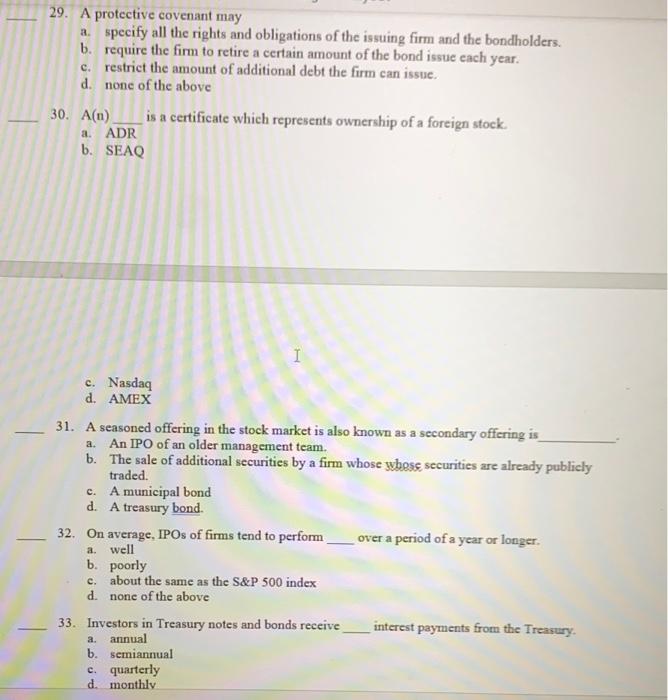

29. A protective covenant may a specify all the rights and obligations of the issuing firm and the bondholders. b. require the firm to retire a certain amount of the bond issue each year. c. restrict the amount of additional debt the firm can issue d. none of the above 30. A(n) is a certificate which represents ownership of a foreign stock a. ADR b. SEAQ c. Nasdaq d. AMEX 31. A seasoned offering in the stock market is also known as a secondary offering is a. An IPO of an older management team. b. The sale of additional securities by a firm whose whose securities are already publicly traded c. A municipal bond d. A treasury bond. 32. On average, IPOs of firms tend to perform over a period of a year or longer. a. well b. poorly c. about the same as the S&P 500 index d. none of the above 33. Investors in Treasury notes and bonds receive interest payments from the Treasury. a. annual b. semiannual c. quarterly d. monthly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts