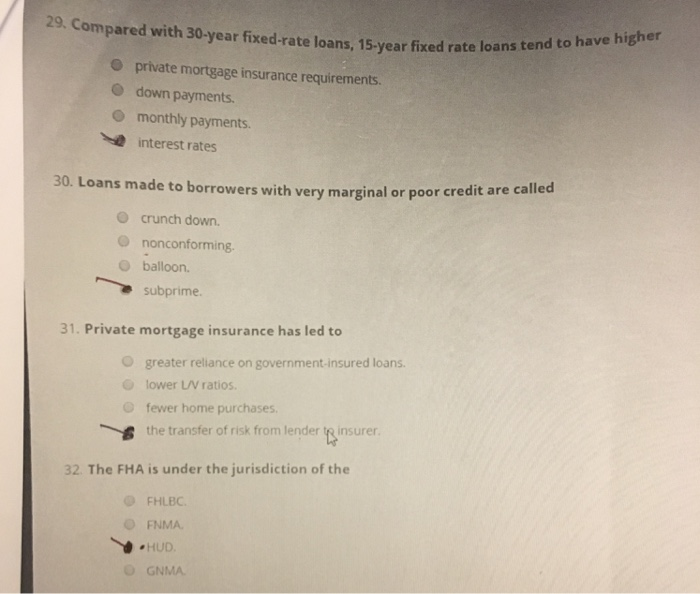

Question: 29. Compared with 30-year fixed-rate loans, 15-year fixed rate loans tend to O private mortgage insurance requirements. O down payments. O monthly payments interest rates

29. Compared with 30-year fixed-rate loans, 15-year fixed rate loans tend to O private mortgage insurance requirements. O down payments. O monthly payments interest rates Loans made to borrowers with very marginal or poor credit are called 30. o crunch down. O nonconforming. O balloon. subprime. 31. Private mortgage insurance has led to greater reliance on government-insured loans. lower VV ratios O O fewer home purchases the transfer of risk from lender te insurer 32 The FHA is under the jurisdiction of the FHLB FNMA HUD OGNMA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts