Question: 29 Example 1.1 Hedging with forward contracts It is June 22, 2012. ImportCo must pay 10 million on September 22, 2012, for goods purchased from

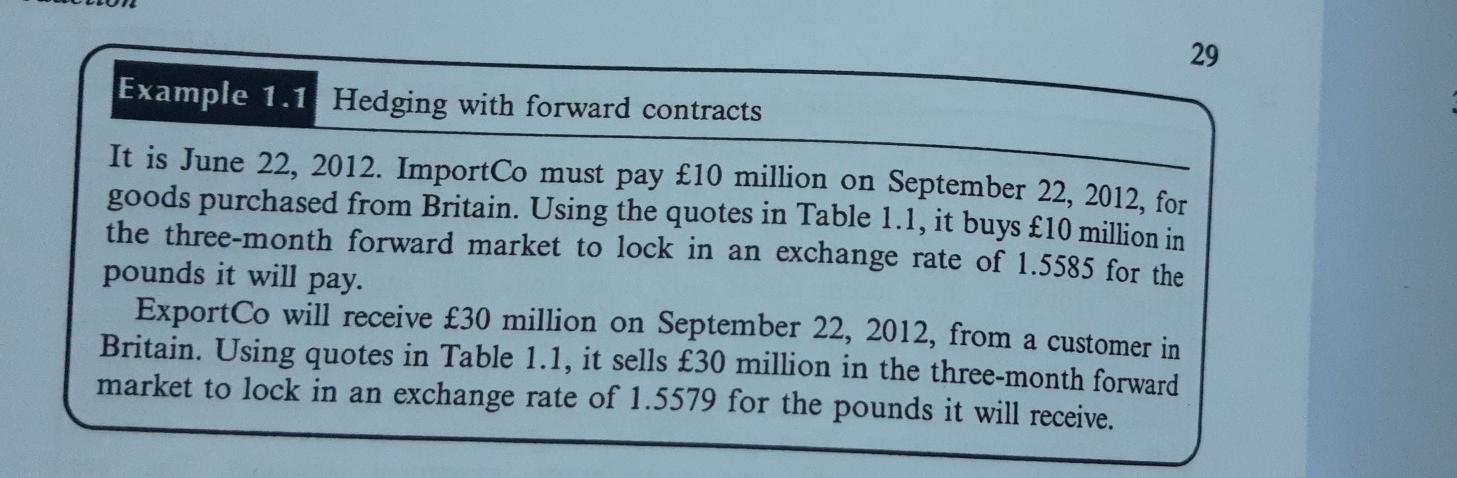

29 Example 1.1 Hedging with forward contracts It is June 22, 2012. ImportCo must pay 10 million on September 22, 2012, for goods purchased from Britain. Using the quotes in Table 1.1, it buys 10 million in the three-month forward market to lock in an exchange rate of 1.5585 for the pounds it will pay. ExportCo will receive 30 million on September 22, 2012, from a customer in Britain. Using quotes in Table 1.1, it sells 30 million in the three-month forward market to lock in an exchange rate of 1.5579 for the pounds it will receive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts