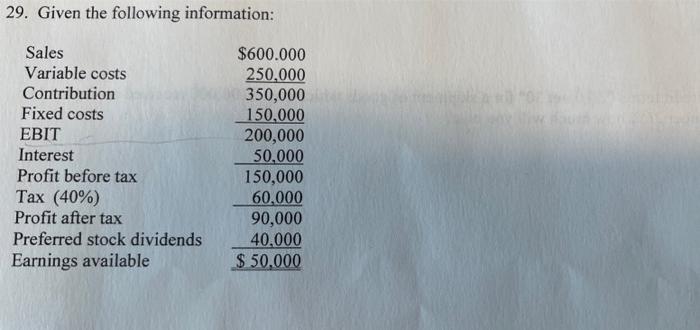

Question: 29. Given the following information: Sales Variable costs Contribution Fixed costs EBIT Interest Profit before tax Tax (40%) Profit after tax Preferred stock dividends Earnings

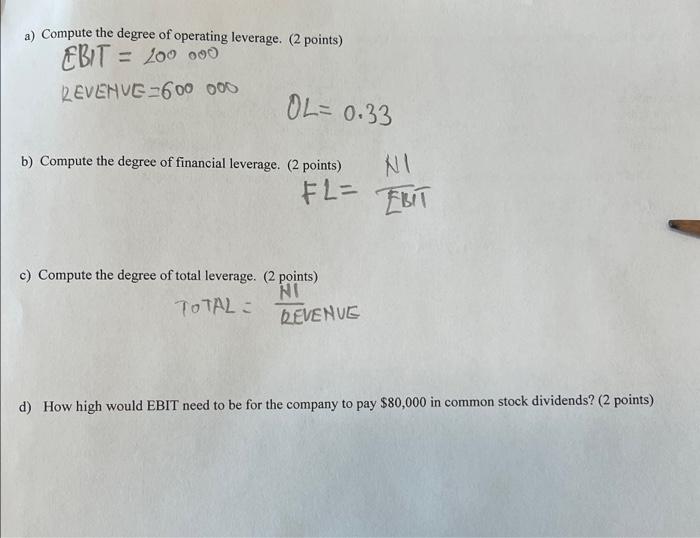

29. Given the following information: Sales Variable costs Contribution Fixed costs EBIT Interest Profit before tax Tax (40%) Profit after tax Preferred stock dividends Earnings available $600.000 250,000 350,000 150,000 200,000 50,000 150,000 60,000 90,000 40.000 $ 50.000 a) Compute the degree of operating leverage. (2 points) EBIT = 200 000 REVENUE=600 000 OL= 0.33 b) Compute the degree of financial leverage. (2 points) NI FL= EBIT c) Compute the degree of total leverage. (2 points) NO TOTAL = REVENUE d) How high would EBIT need to be for the company to pay $80,000 in common stock dividends? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts