Question: 29. Goodwill A) can be sold by itself to another company B) can be purchased and charged directly to stockholders equiy Dl is only recorded

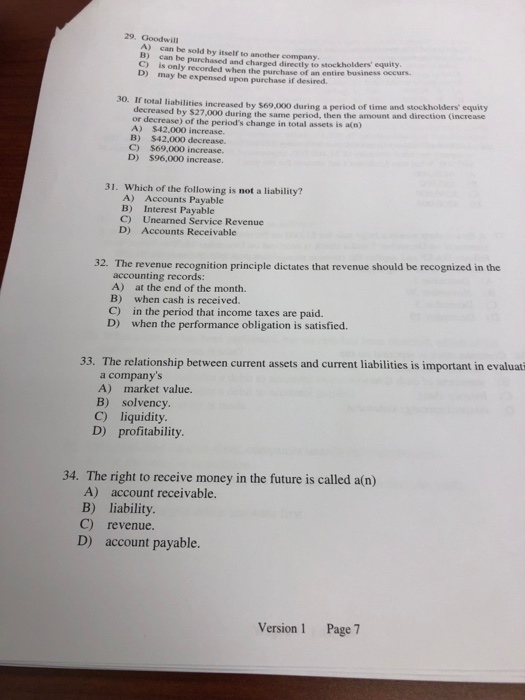

29. Goodwill A) can be sold by itself to another company B) can be purchased and charged directly to stockholders equiy Dl is only recorded when the purchase of an entire business oecurs may be expensed upon purchase if desired. 30. If total liabilities increased by $69,000 during a period of time and stockholders' equity and direction (increase decreased by $27,000 during the same period, then the amount or decrease) of the period's change in total assets is a(n) A) $42.000 increase. B) $42,000 decrease. C) $69,000 increase. D) $96,000 increase. 31. Which of the following is not a liability? A) Accounts Payable B) Interest Payable C) Unearned Service Revenue D) Accounts Receivable 32. The revenue recognition principle dictates that revenue should be recognized in the accounting records: A) at the end of the month. B) when cash is received. C) in the period that income taxes are paid. D) when the performance obligation is satisfied 33. The relationship between current assets and current liabilities is important in evaluati a company's A) market value. B) solvency C) liquidity D) profitability. 34. The right to receive money in the future is called a(n) A) account receivable. B) liability C) revenue D) account payable. Version 1 Page 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts