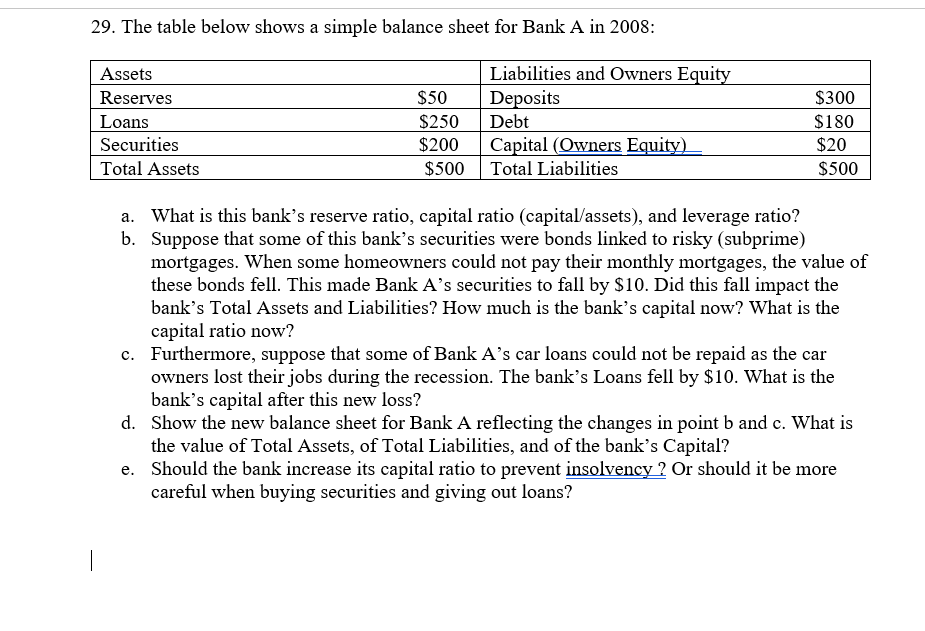

Question: 29. The table below shows a simple balance sheet for Bank A in 2008: Assets Reserves Loans Securities Total Assets $50 $250 $200 $500 Liabilities

29. The table below shows a simple balance sheet for Bank A in 2008: Assets Reserves Loans Securities Total Assets $50 $250 $200 $500 Liabilities and Owners Equity Deposits Debt Capital (Owners Equity) Total Liabilities $300 $180 $20 $500 a. What is this bank's reserve ratio, capital ratio (capital/assets), and leverage ratio? b. Suppose that some of this bank's securities were bonds linked to risky (subprime) mortgages. When some homeowners could not pay their monthly mortgages, the value of these bonds fell. This made Bank A's securities to fall by $10. Did this fall impact the banks Total Assets and Liabilities? How much is the bank's capital now? What is the capital ratio now? c. Furthermore, suppose that some of Bank A's car loans could not be repaid as the car owners lost their jobs during the recession. The bank's Loans fell by $10. What is the bank's capital after this new loss? d. Show the new balance sheet for Bank A reflecting the changes in point b and c. What is the value of Total Assets, of Total Liabilities, and of the bank's Capital? e. Should the bank increase its capital ratio to prevent insolvency ? Or should it be more careful when buying securities and giving out loans? 29. The table below shows a simple balance sheet for Bank A in 2008: Assets Reserves Loans Securities Total Assets $50 $250 $200 $500 Liabilities and Owners Equity Deposits Debt Capital (Owners Equity) Total Liabilities $300 $180 $20 $500 a. What is this bank's reserve ratio, capital ratio (capital/assets), and leverage ratio? b. Suppose that some of this bank's securities were bonds linked to risky (subprime) mortgages. When some homeowners could not pay their monthly mortgages, the value of these bonds fell. This made Bank A's securities to fall by $10. Did this fall impact the banks Total Assets and Liabilities? How much is the bank's capital now? What is the capital ratio now? c. Furthermore, suppose that some of Bank A's car loans could not be repaid as the car owners lost their jobs during the recession. The bank's Loans fell by $10. What is the bank's capital after this new loss? d. Show the new balance sheet for Bank A reflecting the changes in point b and c. What is the value of Total Assets, of Total Liabilities, and of the bank's Capital? e. Should the bank increase its capital ratio to prevent insolvency ? Or should it be more careful when buying securities and giving out loans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts