Question: 29. You're analyzing a small project which would require an initial investment and then would return positive cash flows in years 1 through 3. Initial

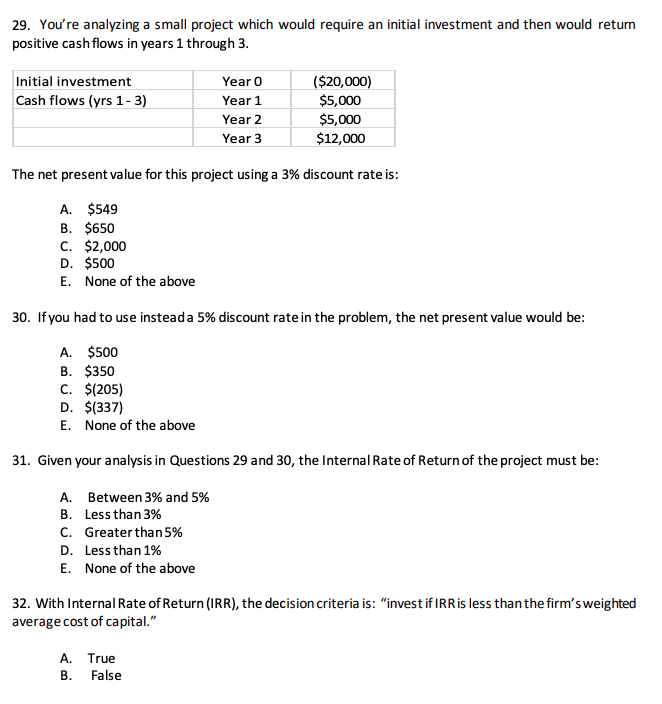

29. You're analyzing a small project which would require an initial investment and then would return positive cash flows in years 1 through 3. Initial investment Cash flows (yrs 1-3) Year 0 Year 1 Year 2 Year 3 ($20,000) $5,000 $5,000 $12,000 The net present value for this project using a 3% discount rate is: A. $549 B. $650 C. $2,000 D. $500 E. None of the above 30. If you had to use insteada 5% discount rate in the problem, the net present value would be A. $500 B. $350 C. $(205) D. $(337) E. None of the above 31. Given your analysis in Questions 29 and 30, the Internal Rate of Return of the project must be: A. Between 3% and 5% B. Less than 3% C. Greater than 5% D. Less than 1% E. None of the above 32. With Internal Rate of Return (IRR), the decision criteria is: "invest if IRR is less than the firm's weighted average cost of capital." A. True B. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts