Question: 29&30 only with solution 18. Using the data in the preceding number, compute estate tax dun assuming the decedent is A nonresident alien. Iton 19

29&30 only with solution

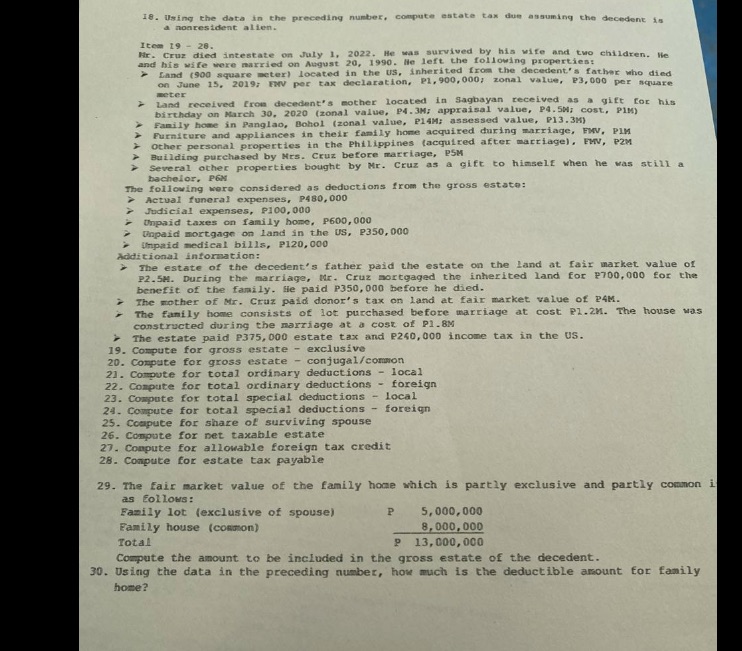

18. Using the data in the preceding number, compute estate tax dun assuming the decedent is A nonresident alien. Iton 19 - 28. He. Cruz died intestate on July 1, 2022. He was survived by his wife and two children. He and his wife were married on August 20, 1990. He left the following properties: Land (900 square meter) located in the US, inherited from the decedent's father who died on June 15, 2019, IV per tax declaration, P1, 909,000, zonal value, P3, 000 per square meter Land received from decedent's mother located in Sagbayan received as a gift for his birthday on March 30, 2020 (zonal value, P4. 3H, appraisal value, P4. 5M, cost, PIN) Family home in Panglao, Bohol (zonal value, Pl4M; assessed value, P13.3M) Furniture and appliances in their family home acquired during marriage, FMV, PIM Other personal properties in the Philippines (acquired after marriage), MV, PZM Building purchased by Mrs. Cruz before marriage, PSM Several other properties bought by Mr. Cruz as a gift to himself when he was still a bachelor, PGM The following were considered as deductions from the gross estate: Actual funeral expenses, P480,000 Judicial expenses, P100,000 Unpaid taxes on family home, P600, 000 Unpaid mortgage on land in the US, P350,000 Umpaid medical bills, P120, 000 Additional information: The estate of the decedent's father paid the estate on the land at fair market value of P2. 5M. During the marriage, Mr. Cruz mortgaged the inherited land for P700, 000 for the benefit of the family. He paid P350, 000 before he died. The mother of Mr. Cruz paid donor's tax on land at fair market value of P4M. The family home consists of lot purchased before marriage at cost Pl. 2M. The house was constructed during the marriage at a cost of P1. BM The estate paid P375, 000 estate tax and P240, 000 income tax in the US. 19. Compute for gross estate - exclusive 20. Compute for gross estate - conjugal/common 21. Compute for total ordinary deductions - local 22. Compute for total ordinary deductions - foreign 23. Compute for total special deductions - local 24. Compute for total special deductions - foreign 25. Compute for share of surviving spouse 26. Compute for net taxable estate 27. Compute for allowable foreign tax credit 28. Compute for estate tax payable 29. The fair market value of the family home which is partly exclusive and partly common i as Follows: Family lot (exclusive of spouse) P 5,000,000 Family house (common) 8, 000, 000 Total P 13, 000, 000 Compute the amount to be included in the gross estate of the decedent. 30. Using the data in the preceding number, how much is the deductible amount for family home

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts