Question: 2.a. A first-round draft choice goalkeeper has been signed to a three-year, $10 million contract. The details provide for an immediate cash bonus of

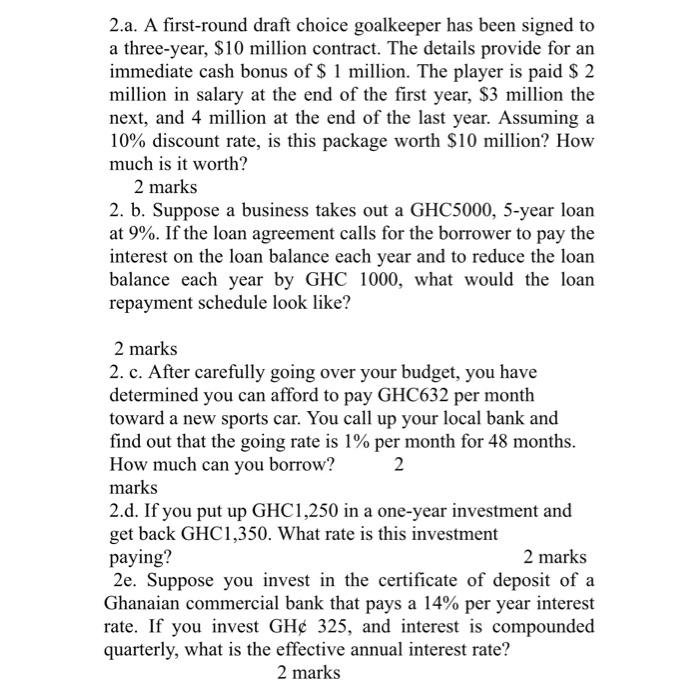

2.a. A first-round draft choice goalkeeper has been signed to a three-year, $10 million contract. The details provide for an immediate cash bonus of $ 1 million. The player is paid $ 2 million in salary at the end of the first year, $3 million the next, and 4 million at the end of the last year. Assuming a 10% discount rate, is this package worth $10 million? How much is it worth? 2 marks 2. b. Suppose a business takes out a GHC5000, 5-year loan at 9%. If the loan agreement calls for the borrower to pay the interest on the loan balance each year and to reduce the loan balance each year by GHC 1000, what would the loan repayment schedule look like? 2 marks 2. c. After carefully going over your budget, you have determined you can afford to pay GHC632 per month toward a new sports car. You call up your local bank and find out that the going rate is 1% per month for 48 months. How much can you borrow? 2 marks 2.d. If you put up GHC1,250 in a one-year investment and get back GHC1,350. What rate is this investment paying? 2 marks 2e. Suppose you invest in the certificate of deposit of a Ghanaian commercial bank that pays a 14% per year interest rate. If you invest GH 325, and interest is compounded quarterly, what is the effective annual interest rate? 2 marks

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

2a To determine the worth of the contract package we need to calculate the present value of the cash flows using a discount rate of 10 Immediate cash ... View full answer

Get step-by-step solutions from verified subject matter experts