Question: 2(a) Compare Projects Alpha and Beta by using the incremental NPW and incremental IRR analysis method. Cash flow items are given in actual dollars. The

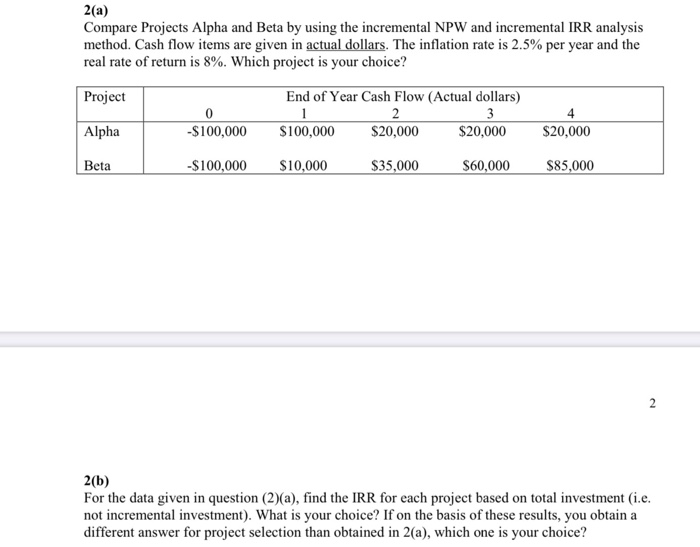

2(a) Compare Projects Alpha and Beta by using the incremental NPW and incremental IRR analysis method. Cash flow items are given in actual dollars. The inflation rate is 2.5% per year and the real rate of return is 8%. Which project is your choice? Project End of Year Cash Flow (Actual dollars) Alpha -$100,000 $100,000 $20,000 $20,000 $20,000 Beta -$100,000 $10,000 $35,000 $60,000 $85,000 2(b) For the data given in question (2)(a), find the IRR for each project based on total investment (i.e. not incremental investment). What is your choice? If on the basis of these results, you obtain a different answer for project selection than obtained in 2(a), which one is your choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts