Question: An investor has a portfolio consisting of 200 put options on stock A, with a strike price of 40, and 10 shares of stock

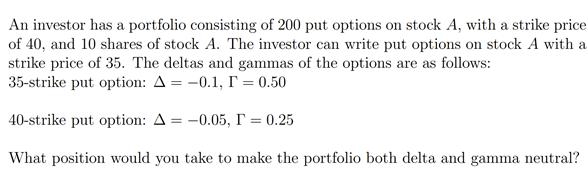

An investor has a portfolio consisting of 200 put options on stock A, with a strike price of 40, and 10 shares of stock A. The investor can write put options on stock A with a strike price of 35. The deltas and gammas of the options are as follows: 35-strike put option: A = -0.1, r=0.50 40-strike put option: A = -0.05, T = 0.25 What position would you take to make the portfolio both delta and gamma neutral?

Step by Step Solution

3.57 Rating (161 Votes )

There are 3 Steps involved in it

Given Information No of 40strike Put options in Portfolio ... View full answer

Get step-by-step solutions from verified subject matter experts