Question: 2a Optimal Hedge ratio? 2b What postion should abc take in gasoline futures? 2c how many contracts should be traded? 2. [2 points] ABC Express

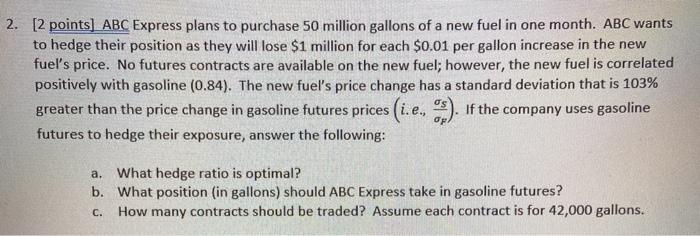

2. [2 points] ABC Express plans to purchase 50 million gallons of a new fuel in one month. ABC wants to hedge their position as they will lose $1 million for each $0.01 per gallon increase in the new fuel's price. No futures contracts are available on the new fuel; however, the new fuel is correlated positively with gasoline (0.84). The new fuel's price change has a standard deviation that is 103% greater than the price change in gasoline futures prices (i.e. 9). If the company uses gasoline futures to hedge their exposure, answer the following: a. What hedge ratio is optimal? b. What position (in gallons) should ABC Express take in gasoline futures? C. How many contracts should be traded? Assume each contract is for 42,000 gallons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts