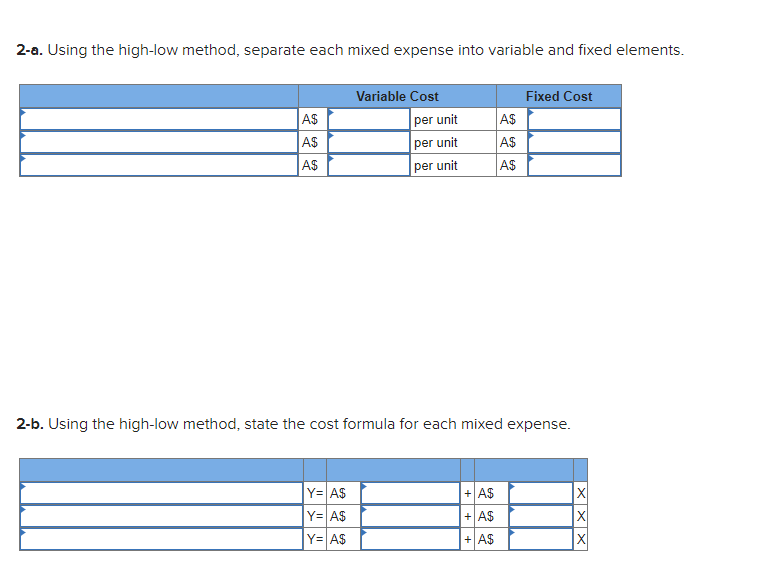

Question: 2-a. Using the high-low method, separate each mixed expense into variable and fixed elements. 2-b. Using the high-low method, state the cost formula for each

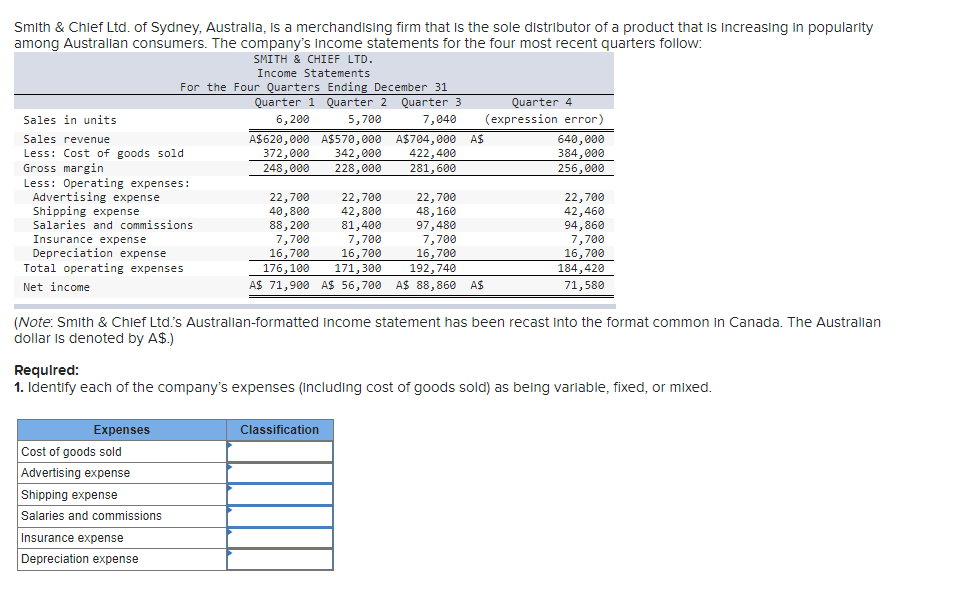

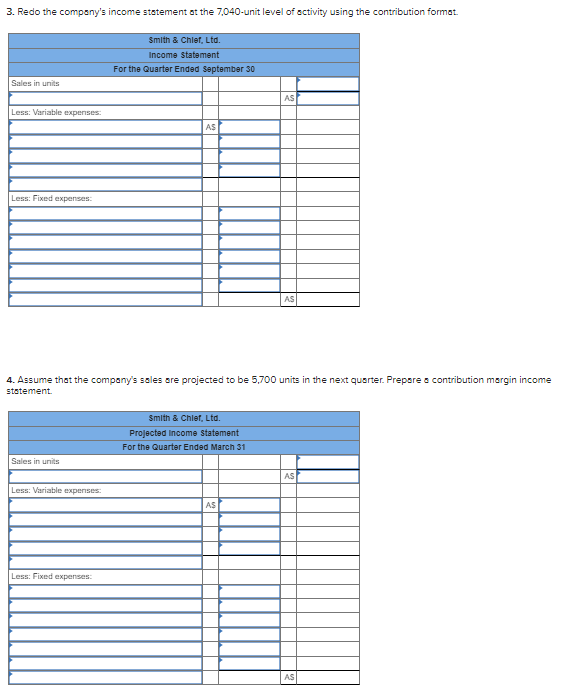

2-a. Using the high-low method, separate each mixed expense into variable and fixed elements. 2-b. Using the high-low method, state the cost formula for each mixed expense. Smith \& Chief Ltd. of Sydney, Australia, is a merchandising firm that is the sole distributor of a product that is Increasing in popularity among Australian consumers. The company's income statements for the four most recent quarters follow: (Note: SmIth \& Chief Ltd.'s Australlan-formatted Income statement has been recast Into the format common In Canada. The Australian dollar is denoted by A$.) Required: 1. Identify each of the company's expenses (Including cost of goods sold) as being varlable, fixed, or mixed. 3. Redo the compony's income statement at the 7,040-unit level of activity using the contribution format. 4. Assume that the company's sales are projected to be 5,700 units in the next quarter. Prepsre contribution margin income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts