Question: 2.based on the following data, would beth and roger simmons recieve a refund or owe additional taxes? 3. using the tax table in exhibit 3-5

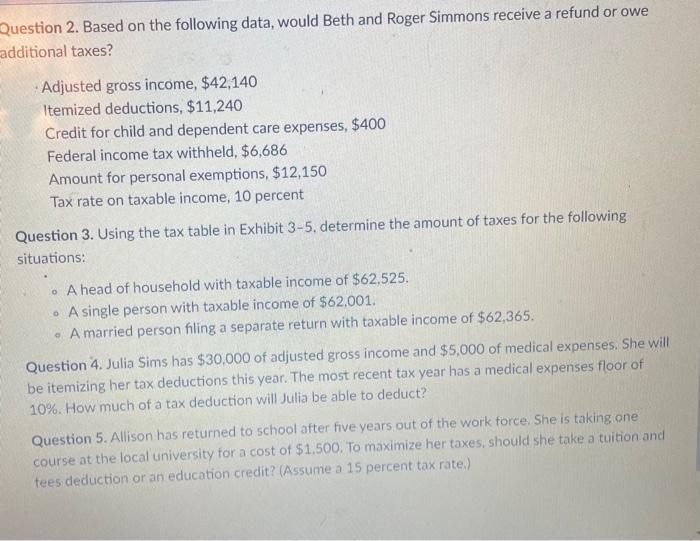

Suestion 2. Based on the following data, would Beth and Roger Simmons receive a refund or owe dditional taxes? Adjusted gross income, $42,140 Itemized deductions, $11,240 Credit for child and dependent care expenses, $400 Federal income tax withheld, $6,686 Amount for personal exemptions, \$12,150 Tax rate on taxable income, 10 percent Question 3. Using the tax table in Exhibit 3-5, determine the amount of taxes for the following situations: - A head of household with taxable income of $62,525. - A single person with taxable income of $62,001. - A married person filing a separate return with taxable income of $62,365. Question 4. Julia Sims has $30,000 of adjusted gross income and $5,000 of medical expenses. She will be itemizing her tax deductions this year. The most recent tax year has a medical expenses floor of 10%. How much of a tax deduction will Julia be able to deduct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts