Question: 2don't attempt if you aren't confident in your ability. will thumbs down incorrect answers. The Plastics DIvision of Minock Manufacturing currently earns $3.48 million and

2don't attempt if you aren't confident in your ability. will thumbs down incorrect answers.

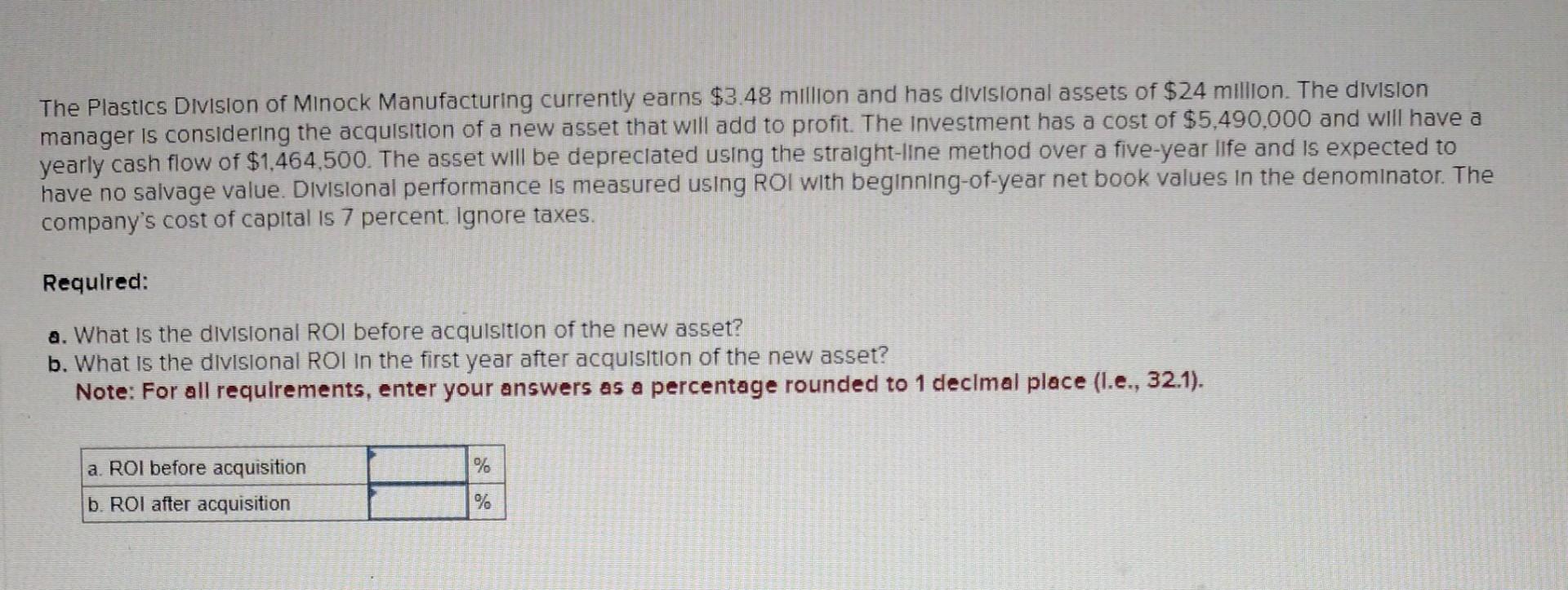

The Plastics DIvision of Minock Manufacturing currently earns $3.48 million and has divisional assets of $24 million. The division manager is considering the acquisition of a new asset that will add to profit. The Investment has a cost of $5,490,000 and will have a yearly cash flow of $1,464,500. The asset will be depreclated using the straight-line method over a five-year life and is expected to have no salvage value. Divisional performance is measured using ROI with beginning-of-year net book values in the denominator. The company's cost of capital is 7 percent. Ignore taxes. Requlred: a. What is the divisional ROI before acquisition of the new asset? b. What is the divisional ROI In the first year after acquisition of the new asset? Note: For all requlrements, enter your answers as a percentage rounded to 1 declmal place (I.e., 32.1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts