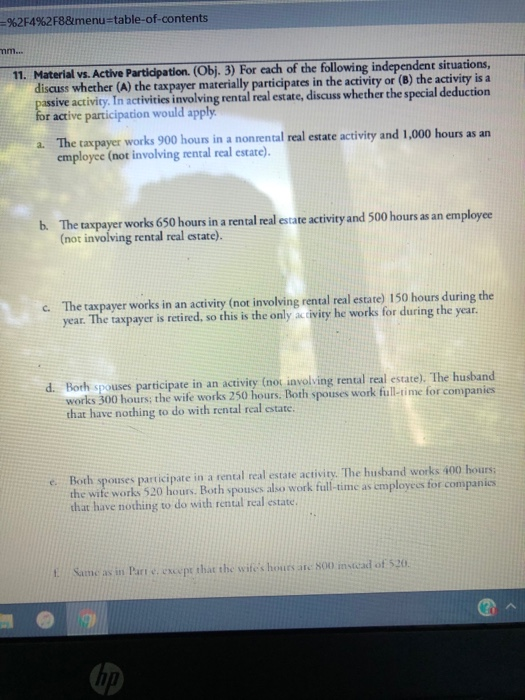

Question: =%2F4%2F8&menu=table-of-contents mm... 11. Material vs. Active Partidpation. (Obj. 3) For each of the following independent situations, discuss whether (A) the taxpayer materially participates in the

=%2F4%2F8&menu=table-of-contents mm... 11. Material vs. Active Partidpation. (Obj. 3) For each of the following independent situations, discuss whether (A) the taxpayer materially participates in the activity or (B) the activity is a passive activity. In activities involving rental real estate, discuss whether the special deduction for active participation would apply 2. The taxpayer works 900 hours in a nonrental real estate activity and 1,000 hours as an employee (not involving rental real estate). b. The taxpayer works 650 hours in a rental real estate activity and 500 hours as an employee (not involving rental real estate). c. The taxpayer works in an activity (not involving rental real estate) 150 hours during the year. The taxpayer is retired, so this is the only activity he works for during the year. d. Both spouses participate in an activity (not involving rental real estate). The husband works 300 hours: the wife works 250 hours. Both spouses work full-time for companies that have nothing to do with rental real estate. Both spouses participate in a rental real estate activity. The husband works 400 hours: the wife works 520 hours. Both spouses also work full-time as employees for companies that have nothing to do with rental real estate. Same as in Parape that the wife's hours are 800 instad of 520 hp =%2F4%2F8&menu=table-of-contents mm... 11. Material vs. Active Partidpation. (Obj. 3) For each of the following independent situations, discuss whether (A) the taxpayer materially participates in the activity or (B) the activity is a passive activity. In activities involving rental real estate, discuss whether the special deduction for active participation would apply 2. The taxpayer works 900 hours in a nonrental real estate activity and 1,000 hours as an employee (not involving rental real estate). b. The taxpayer works 650 hours in a rental real estate activity and 500 hours as an employee (not involving rental real estate). c. The taxpayer works in an activity (not involving rental real estate) 150 hours during the year. The taxpayer is retired, so this is the only activity he works for during the year. d. Both spouses participate in an activity (not involving rental real estate). The husband works 300 hours: the wife works 250 hours. Both spouses work full-time for companies that have nothing to do with rental real estate. Both spouses participate in a rental real estate activity. The husband works 400 hours: the wife works 520 hours. Both spouses also work full-time as employees for companies that have nothing to do with rental real estate. Same as in Parape that the wife's hours are 800 instad of 520 hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts