Question: 2.LO 6.2: AC vs. FIFO vs. LIFO (s) Information about Beerbo's January inventory records are as follows units cost/unit cost date ($) Jan. 1 Beginning

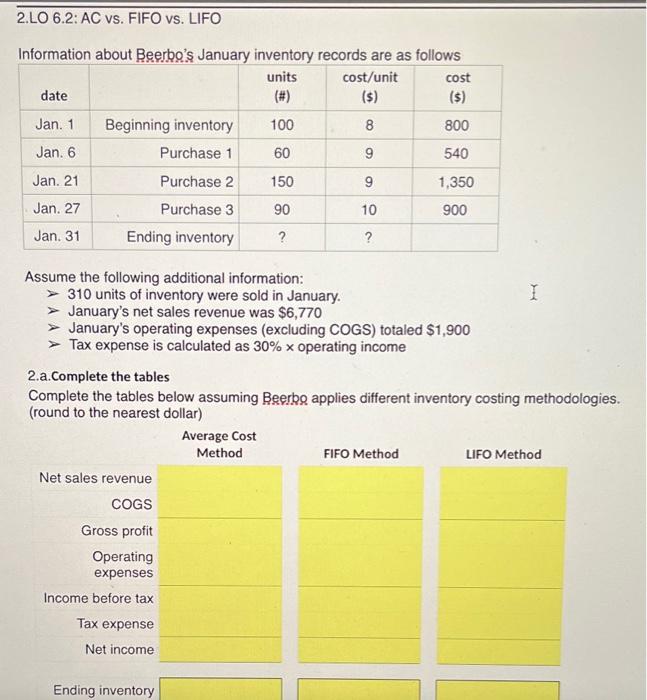

2.LO 6.2: AC vs. FIFO vs. LIFO (s) Information about Beerbo's January inventory records are as follows units cost/unit cost date ($) Jan. 1 Beginning inventory 100 8 800 Jan. 6 Purchase 1 60 9 540 Jan. 21 Purchase 2 150 9 1,350 Jan. 27 Purchase 3 90 10 900 Jan. 31 Ending inventory ? ? Assume the following additional information: 310 units of inventory were sold in January I January's net sales revenue was $6,770 January's operating expenses (excluding COGS) totaled $1,900 > Tax expense is calculated as 30% x operating income 2.a.Complete the tables Complete the tables below assuming Beerke applies different inventory costing methodologies. (round to the nearest dollar) Average Cost Method FIFO Method LIFO Method Net sales revenue COGS Gross profit Operating expenses Income before tax Tax expense Net income Ending inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts