Question: 2question.... prepare closing entries at august 31st, 2021. 3question.... prepare a balance sheet form as at december 31,2021. information is given below: Question 2 of

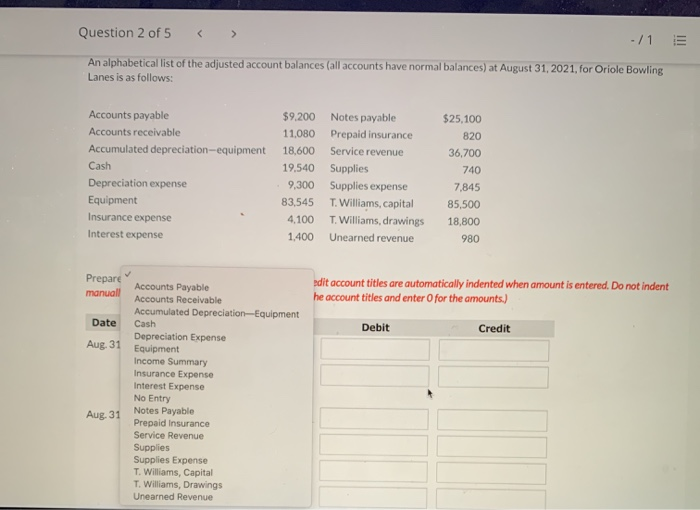

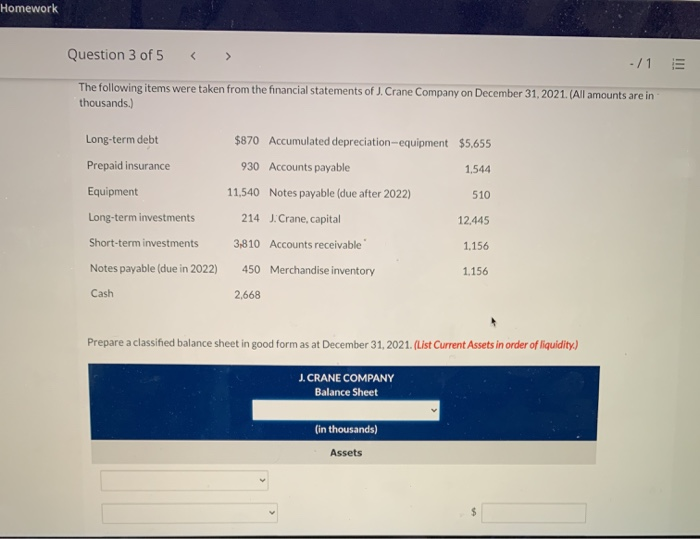

Question 2 of 5 -11 An alphabetical list of the adjusted account balances (all accounts have normal balances) at August 31, 2021, for Oriole Bowling Lanes is as follows: Accounts payable Accounts receivable Accumulated depreciation equipment Cash Depreciation expense Equipment Insurance expense Interest expense $9.200 Notes payable 11,080 Prepaid insurance 18,600 Service revenue 19,540 Supplies 9,300 Supplies expense 83,545 T. Williams, capital 4.100 T. Williams, drawings 1.400 Unearned revenue $25,100 820 36,700 740 7,845 85,500 18.800 980 Prepare manuall pdit account titles are automatically indented when amount is entered. Do not indent he account titles and enter for the amounts.) Debit Credit Date Aug. 31 Accounts Payable Accounts Receivable Accumulated Depreciation Equipment Cash Depreciation Expense Equipment Income Summary Insurance Expense Interest Expense No Entry Notes Payable Prepaid Insurance Service Revenue Supplies Supplies Expense T. Williams, Capital T. Williams, Drawings Unearned Revenue Aug. 31 Homework Question 3 of 5 > - /1 The following items were taken from the financial statements of J.Crane Company on December 31, 2021. (All amounts are in thousands.) Long-term debt Prepaid insurance Equipment Long-term investments Short-term investments Notes payable (due in 2022) Cash $870 Accumulated depreciation-equipment $5,655 930 Accounts payable 1,544 11,540 Notes payable (due after 2022) 510 214 J.Crane, capital 12.445 3,810 Accounts receivable' 1.156 450 Merchandise inventory 1.156 2.668 Prepare a classified balance sheet in good form as at December 31, 2021. (List Current Assets in order of liquidity) J.CRANE COMPANY Balance Sheet (in thousands) Assets $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts