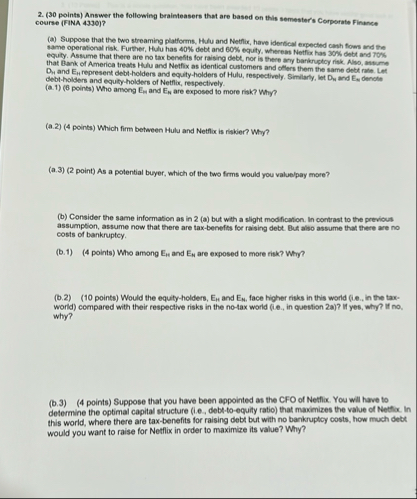

Question: ( 3 0 points ) Answer the following brainteasers that are based on thls semester's Corporate Finance course ( FINA 4 3 3 0 )

points Answer the following brainteasers that are based on thls semester's Corporate Finance course FINA

a Suppose that the two streaming platforms, Hhlu and Nethix, have iderfical erpected cash flows and the same operabional risk. Further, Hulu has debt and equity, whereas Nettix has debt and equity. Assume that there are no tax benefits for raising debt, nor is there ary barkrugtoy risk. Also, antume that Bank of America treats Hulu and Netfix as identical customers and otlers them the same debt ribe. Let and represent debiholders and equityholders of Hulu, respectively. Similarly, let and Esudenote debtholders and equityholders of Netfix, respectively.

a points Who ansong and are exposed to more risk? Why?

a points Which firm between Hulu and Netfix is riakier? Why?

a point As a potential buyer, which of the two frms would you valuelpay more?

b Consider the same information as in a but with a slight modification. In contrast to the previous assumption, assume now that there are taxbenefiss for raising debt. But also assume that there are no costs of bankruptcy.

b points Who among and are exposed to more risk? Wry

b points Would the equityholders, EH and face higher risks in this world ie in the taxworld compared with their respective risks in the notax world ie in question a if yes, why? if no why?

b points Suppose that you have been appointed as the CFO of Netfix. You will have to determine the optimal capital structure ie debttoequity ratio that maximizes the value of Nettix. in this world, where there are taxbenefits for raising debt but with no bankruptcy costs, how much debt would you want to raise for Netflix in order to maximize its value? Why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock