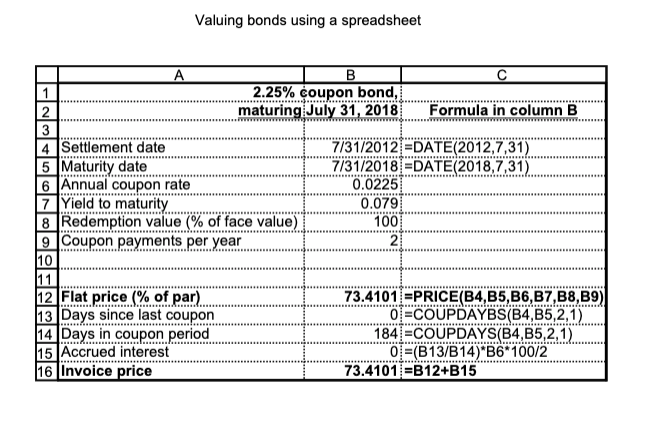

Question: 3 (0.25). Open Bond Pricing Spreadsheet. The spreadsheet shows you how to calculate invoice price for 6-year maturity bond with a coupon rate of 2.25%

3 (0.25). Open Bond Pricing Spreadsheet. The spreadsheet shows you how to calculate

invoice price for 6-year maturity bond with a coupon rate of 2.25% (paid semiannually).

The market interest rate given is 7.9%. Now, please modify the spreadsheet and calculate

invoice price of bond with 6.25% coupon (paid semiannually), settlement date July

31,2012, maturity date May 15, 2030, YTM 7.9%.

Valuing bonds using a spreadsheet 2.25%coupon bond, maturingiJuly 31, 2018 Formula in column B 4 Settlement date 5 Marit date.. 6 Annual coupon rate 7 Yield to maturity 8|Redemption value(% of face value) | 7/31/2012 DATE(2012,7,31) 7/31/2018 DATE(2018,7,31 0.02257"" 100: 2: 12 73.4101 PRICE (B4,B5,B6,B7,B8,B9) 2Fla price. .1%..ofpar) 13 Day since last coupon 14 Days in coupon period 15 Accrued interest 16 Invoice price 0 COUPDAYBS(B4,B5,2,1) 184 COUPDAYS(B4,B5,2,1) 0%(B13/B14)"B6" 100/2 73.4101-B12+B15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts