Question: 3. (0.5 point for the correct answer) Howard Corporation reported net income before its charitable contribution deduction of $220,000 in 2020. During 2020, Howard made

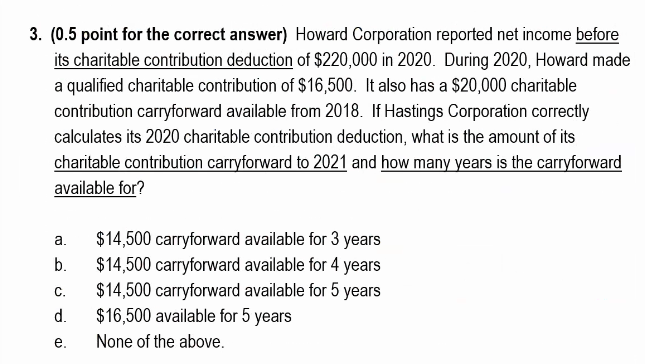

3. (0.5 point for the correct answer) Howard Corporation reported net income before its charitable contribution deduction of $220,000 in 2020. During 2020, Howard made a qualified charitable contribution of $16,500. It also has a $20,000 charitable contribution carryforward available from 2018. If Hastings Corporation correctly calculates its 2020 charitable contribution deduction, what is the amount of its charitable contribution carryforward to 2021 and how many years is the carryforward available for? a. b. C. $14,500 carryforward available for 3 years $14,500 carryforward available for 4 years $14,500 carryforward available for 5 years $16,500 available for 5 years None of the above. d. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts